What Are the Dogs of the Dow? How Do I Invest in Them?

Aug 27, 2023Hello Stoic Investors,

Today I want to talk about an uncommon investment strategy.

Investment strategies change a lot.

New technology enables more advanced approaches that often overthrow old styles.

But the core remains the same.

Beat the market.

With that in mind, let me introduce an investment strategy you probably haven’t heard of yet.

What are the “dogs of the dow”?

You've probably heard of the Dow Jones Industrial Average, or simply "the Dow."

It's a popular American stock market index consisting of 30 large-cap companies known as blue chips.

These companies, like Coca-Cola and Apple, have a solid track record of growth and earnings over the

years.

And they often pay their shareholders back in the form of dividends.

Now, let's talk about the "Dogs of the Dow."

It's not just a catchy name; it's an investment strategy that focuses on the top 10 companies in the Dow

Jones Industrial Average with the highest dividend yields.

The goal is to outperform the overall performance of the DJIA by investing specifically in these dividend-rich

companies.

I know what your next question is.

Does it work?

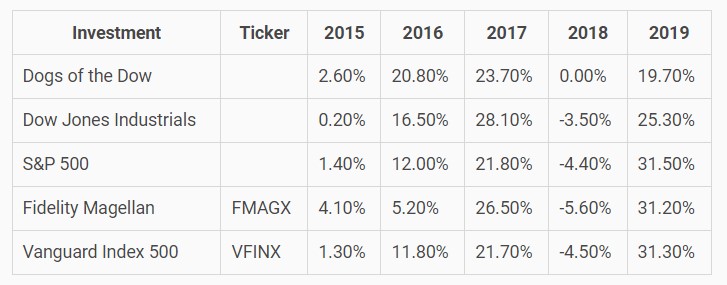

Interestingly, this approach worked better than simple index investing in the S&P 500.

However, it's worth noting that this strategy tends to be more effective during market years that favor value-

based investment approaches.

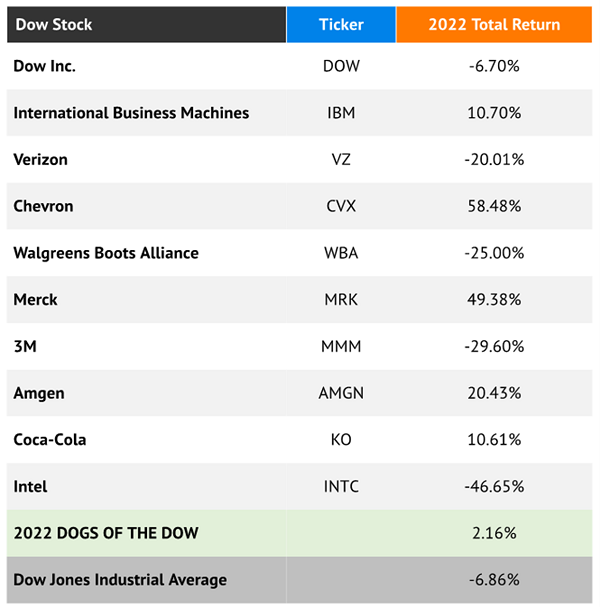

Here is more data, featuring last year’s return.

I know what you’re thinking.

How can I invest in this?

I’m sorry to say but no ETF or index fund could make this easier for you.

But here is a step-by-step manual you can use.

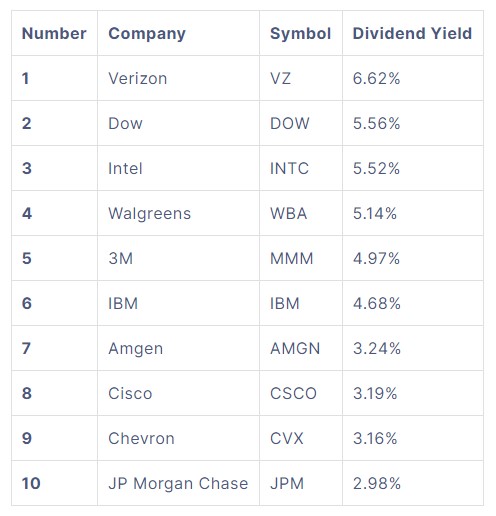

Step 1: Identifying the Dogs of the Dow

At the end of the trading year, find the 10 highest dividend-yielding stocks in the Dow Jones Industrial Average (DJIA). These will be your "Dogs of the Dow."

If you are interested in the new Dogs of the Dow for 2023, here is the list as of 30 December 2022:

Step 2: Investing in the Dogs

On the first trading day of the new year, evenly invest in all 10 Dogs. If you have $10,000 to invest, allocate $1,000 to each of the 10 stocks.

Step 3: Annual Reassessment

Each year, review the list of Dogs and identify any stocks that no longer qualify as Dogs. Sell those stocks and reinvest the proceeds equally in the 10 current Dogs of the Dow.

Do keep in mind that this is an active investing strategy that will require you to spend some time managing

your portfolio.

So, note down these points and start investing today:

- The “Dogs of the Dow” it's an investment strategy that focuses on the top 10 companies in the Dow Jones Industrial Average with the highest dividend yields

- The goal is to outperform the overall performance of the DJIA by investing specifically in these dividend-rich companies

- From 2015-2018 his approach worked better than simple index investing in the S&P 500