TSI #43: How often should you invest to maximize your growth?

Apr 23, 2023Hello Stoic Investors,

Today I want to focus on your money. To be more specific, I want to talk about how you invest your money.

If you have a few thousand dollars waiting to be invested or if you are struggling to find the right approach, then this article is perfect for you.

I am pretty sure your first thought is to invest it all.

After all, that is what investing is all about, right?

Stop and think

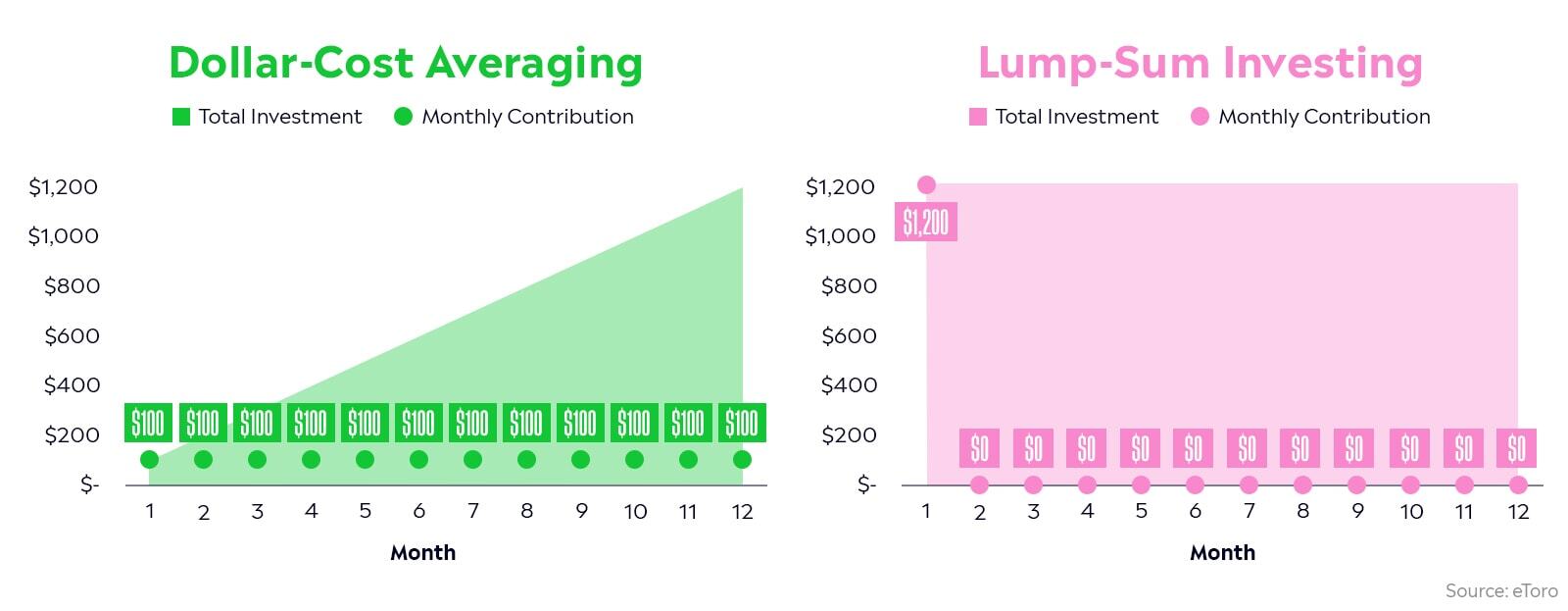

That approach is called "lump-sum investing".

And it requires a strong stomach.

For example, can you handle it if you invest your $10,000 bonus and the market drops 10% or more in the next few months?

Does anyone still remember March 2020?

On the other hand, if you timed it perfectly, and invested that $10,000 bonus after the drop, you could have made some nice money.

But beware.

Such perfect timing has more to do with luck than skill to be honest.

Therefore, for those long-term investors, that want to play it safe…

There is another option

Investing your money at regular intervals – such as weekly, monthly, or quarterly – is called "dollar-cost averaging".

By committing to regular periodic investments, dollar-cost averaging can help take the emotions out of your investing decisions.

Furthermore, by buying in good and bad times, you are avoiding the risk of sudden drops.

Here is a nice image to show the difference between the two mentioned approaches.

If you’re anything like me, then you’re probably curious.

Where can I make more money?

Numerous studies show, that lump-sum investing leads to higher long-term returns.

For example, Vanguard conducted a recent study to compare the outcomes of dollar-cost averaging and lump sum investing in three countries.

The study revealed that in each market, a lump-sum investment outperformed dollar-cost averaging in generating higher portfolio values around two-thirds of the time.

But.

You probably do not have thousands of dollars lying around.

That’s why most investors prefer dollar-cost averaging. Then when they stumble upon some extra cash, they invest it the “lump-sum” style.

By devoting as much as you can, you’re one step closer to early retirement.

It does not matter as much which strategy you follow.

What matters is that you stay consistent

That’s how real money is made.

So, note down these points and start investing today:

- Investing in a lump sum is riskier but offers greater returns

- Investing in regular intervals is more stable but leads to lesser returns

- Great investors use both approaches