Investing Like a Doctor: How to Check If a Company’s Healthy

Jul 27, 2025Hello Stoic Investors,

Today I want to share something really important with you:

How to understand if a company is actually worth investing in.

There are so many stocks out there that it can feel confusing to even know where to begin.

But the truth is, if you learn just a few simple things—what to look for, where to find the right info, and how to think about it—you’ll already be ahead of most people.

Let’s start with a post I came across on Reddit:

These are the three key steps to follow to understand if a company is a good one to invest in:

Step 1: Choose a Sector You Know or Like

A sector is just a group of companies that do similar things.

For example: tech, healthcare, energy, or retail.

Instead of trying to look at all companies, start by picking one sector that you understand or are curious about.

It’s much easier to spot good companies when you already know the kinds of products or services they offer.

Ask yourself:

What industries do I follow in the news? What products do I use and trust? What topics do I enjoy reading about?

Once you’ve chosen a sector, you can focus your research on the companies within that space.

That makes the process a lot more manageable.

Step 2: Check the Financial Health of a Company

Before you invest, you need to make sure the company is financially healthy.

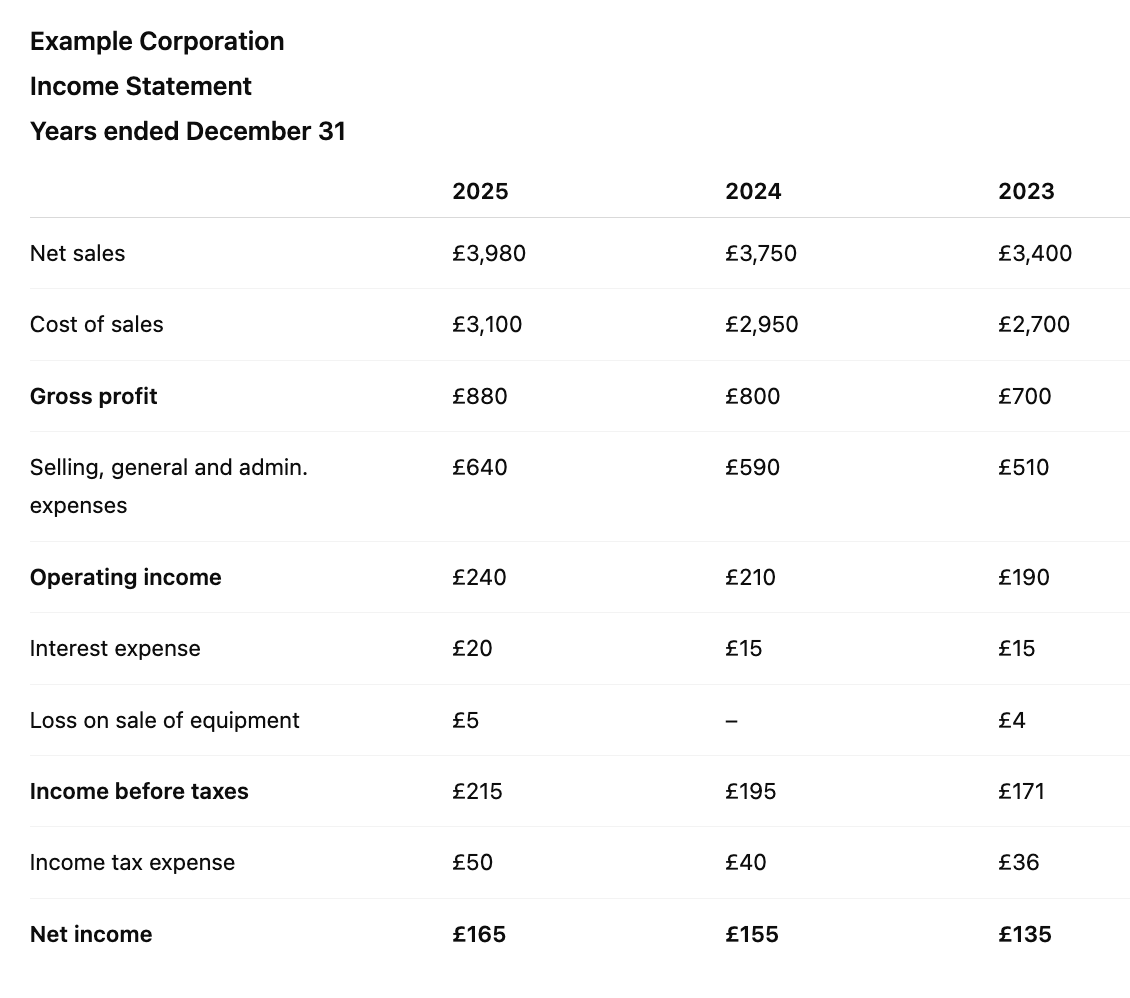

The best way to do that is by reading the Income Statement, also known as the profit and loss (P&L) statement.

This is a document that shows how much money a company made, how much it spent, and what’s left over as profit—or loss.

Think of it like the company’s financial report card.

You want to invest in businesses that are earning more than they spend.

It can differ between countries due to accounting standards, but it more or less looks like this one here:

Here are the key parts of an income statement:

- Net Sales: This is the total money made from selling products or services, after returns or discounts.

- Cost of Goods Sold (COGS): This shows how much it cost to make or buy what they sold.

- Gross Income: What’s left after subtracting COGS from Net Sales.

- Selling, General, and Administrative Expenses (SG&A): Everyday costs of running the business, like salaries, rent, and bills.

- Operating Income: Profit from business operations, before interest and taxes.

- Interest Expense: Money paid on loans or debts.

- Income Before Taxes: What’s left before the company pays taxes.

- Income Taxes: The amount paid to the government.

- Net Income: Final profit after all costs, debts, and taxes are paid.

You can find income statements on sites like Yahoo Finance, Google Finance, or on a company’s Investor Relations page.

In general, a healthy company will show growing Net Sales over time, meaning it's bringing in more and more revenue.

Its Gross Income and Operating Income should also be growing or stable—not shrinking year after year.

You also want to see that Net Income is positive (that means they’re making a profit) and ideally increasing.

If expenses like SG&A or Interest are too high compared to income, that might be a warning sign.

Even if you don’t understand every number, focus on these questions:

Is revenue (sales) growing? Is the company making a profit? Are expenses under control?

Of course, income statements are just one piece of the puzzle.

There are many other ways to evaluate a company—like looking at cash flow, debt levels, competitive position, management quality, or future growth potential.

But if you're just starting out, understanding the income statement is one of the most useful places to begin.

Step 3: Decide How You Want to Invest

After finding companies that look strong, you need to choose how to invest:

By buying individual stocks or through ETFs (exchange-traded funds).

If you buy individual stocks, you're putting your money into a single company.

You choose exactly which business to invest in, and if it does well, you benefit directly.

But this also means more risk—if the company does badly, your money can drop fast.

It also takes more time and effort, because you need to research the company, check its financials, follow the news, and keep track of how it’s doing.

ETFs work differently.

Instead of buying one company, you buy a fund that holds many companies at once—often in the same sector or with a similar theme.

This helps reduce risk because even if one company performs poorly, the others can balance it out.

ETFs also require less research and are usually a safer choice for beginners.

There’s no right or wrong choice—it depends on how much time you want to spend and how comfortable you are with risk.

If you enjoy learning and want full control, individual stocks can make sense. If you prefer something simpler and more stable, ETFs might be a better fit.

Understanding how to spot a solid company is one of the most valuable skills you can build as an investor.

It takes a bit of time to learn, but the payoff is worth it!

So note down these 3 key steps and start investing today:

1. Pick a sector you know or like: It’s easier to invest in what you understand;

2. Check if the company is making money: Use the income statement to spot healthy businesses;

3. Choose how to invest: Go with individual stocks if you want control (and more risk), or ETFs for a simpler, safer option.