TSI #5: Inflation is rising faster than expected

Jul 17, 2022Inflation is rapidly becoming the number one fear of most families. Some businesses are already taking action and increasing wages but it is usually not enough.

The costs of necessities are rising much faster than average income. Therefore, a disproportionate share of the income now goes toward essentials such as housing, transportation and food.

What is the latest data?

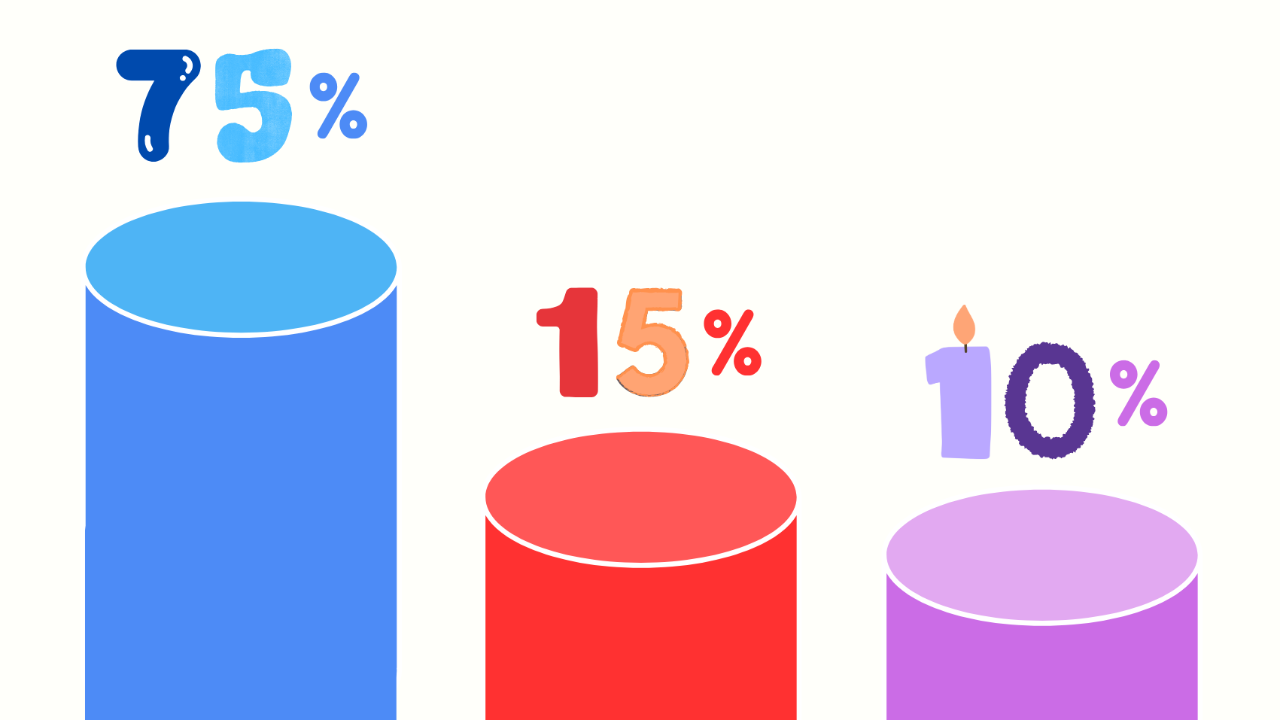

Consumer prices soared 9.1 percent compared with a year earlier, the government said Wednesday, the biggest yearly increase since 1981, and up from an 8.6 percent jump in May. The price of gasoline, for example, increased by 60.6% since June 2021. Imagine how much that affects people who drive several hours to work every day. In the table below, you can find the most recent data.

What can the world do?

Every influential leader has expressed concern over the rapid growth of prices. However, few people actually have the power to control inflation. They are Central Bank chiefs. The most influential of them all, Jerome Powell of the United States, has a very difficult task ahead.

And it is all connected to interest rates. The interest rate is the amount a lender charges a borrower (in this case, the amount the central bank charges the major banks).

Mr. Powell can either raise interest rates, which could eventually cause a recession. If you want to find out why, you can read one of my previous articles (INSERT LINK HERE FOR “SP500 enters bear market”).

Alternatively, he can do nothing and let inflation continue its course. I am guessing the first path is most appropriate. However, that puts tremendous pressure on the stock market. As interest rates rise, the stock market becomes restless.

Why is that?

When stock market analysts calculate the correct prices of investments, they like to use the interest rate as part of their calculation. When it goes up, the fair value of an investment goes down. The “fair value” means the adequate price at which an investment “should” be bought. That is why the market has been in a downtrend for a while. Alongside the numbers thing that I have just described, the increased chances of a recession are also unwelcomed.

Are there any positive results?

Because inflation is getting stronger every month, Jerome Powell will probably have to raise interest rates faster than anticipated. The probability of a record increase is growing daily.

What does this mean for me?

This is not all bad news. On one hand, your portfolio could experience more pain. However, look at this situation from the bright side. Your cost of living will stop increasing as inflation becomes tamed. It is a loss on the portfolio side but a win in the day-to-day life. Furthermore, you will have more cash on hand to take advantage of the discounted prices.

Any bond enthusiasts here?

More great news for risk averse investors. When inflation eventually starts calming down, bonds could get more attractive again. Bonds are fixed rate investments. This means you already know how much return you can expect prior to the purchase. If for example, inflation is 9.1% and treasury bonds offer a 3% return on investment, you are still losing 6.1% in real terms. However, when inflation is lower, bonds may again appear attractive to conservative investors.

Do you think inflation will get worse in July?

To Your Financial Freedom,