How to Fund Retirement Without Running Out of Money

Apr 20, 2025Hello Stoic Investors,

Today, I want to share my thoughts with you on a question I hear often:

Is there such a thing as being too old to invest?

And my answer is NO — or better yet, it’s always better late than never.

Because investing always gives us one more option, one more path, one more possibility.

In fact, especially today (when the future feels uncertain and pension systems are under pressure), investing becomes more than just a financial strategy.

It becomes a way to take back control.

It gives us the power to decide how we want to live, even when we’re no longer working.

This reflection came to me after reading a post on Reddit.

It goes like this:

Now, let’s try to answer it, but to do that, we need to make three realistic guesses.

These won’t be exact, but they’ll help us build a clear and practical example we can learn from:

First, let’s say they’ll both live for another 20 years.

Second, we assume that last year’s $160,000 spending was unusually high, so going forward they could reduce it to $130,000 a year.

Third, they want to leave $300,000 as an inheritance for their children. That means they’re planning to use the remaining $500,000 to fund their retirement.

With $70,000 a year already coming in from pensions, they need to find an extra $60,000 per year to cover their lifestyle.

So, the big question is:

How can they get that extra $60,000 without running out of money too soon?

Let’s look at three simple scenarios.

The worst scenario: They keep the $800,000 in cash

If they don’t invest any of their savings, they can just withdraw $60,000 a year to top up their income.

But if you divide $800,000 by $60,000, you only get about 13 years.

That’s not enough if they live for 20 years.

Plus, leaving the money in cash means it will slowly lose value because of inflation — prices go up over time, but cash doesn’t grow.

So every year, their savings would buy them a little bit less.

This is not a safe long-term plan.

A better (but not the best) scenario: They invest all their savings in the stock market

Now imagine they invest the full $800,000 in stocks.

On average, the stock market has returned around 10% per year over the last few decades.

That means, in a typical year, $800,000 could grow by $80,000 — more than enough to cover the $60,000 they need.

But here’s the problem: the stock market doesn’t go up in a straight line.

Some years it goes down, and sometimes by a lot.

For example, during a bad year, they could lose 30% or even 40% of their money.

At their age, they don’t have the time to wait for the market to recover.

If that loss happens early in retirement, they could run out of money too soon.

So, while stocks can give high returns, they also come with high risk.

That’s why this isn’t the best option for someone in their 80s who needs stability.

The best scenario: They invest the $800,000 in long-term bonds

This is the safest and most stable option for their situation.

Instead of taking big risks in the stock market or keeping all their money in cash, they could invest the full $800,000 in long-term bonds.

Bonds are a type of investment where you lend money to a government or a company, and in return, you get paid interest every year.

In 2025, many government and high-quality corporate bonds offer around 5% interest per year.

So if they invest $800,000, they could earn about $40,000 per year in interest without selling anything.

But they need $60,000 per year to live.

So how can they get the extra $20,000?

The idea is simple:

They take the $40,000 in interest each year, and then they sell a small part of their bond investment — around $20,000 worth — to make up the difference.

When you sell a bond, you get cash back.

That cash, added to the interest, gives them the full $60,000 they need.

Also, they want to keep $300,000 untouched as inheritance for their children.

So the plan is to only spend $500,000 of the total $800,000.

If they sell around $20,000 of bonds per year, over 25 years they will have sold $500,000 total — exactly the part they planned to use.

The remaining $300,000 stays invested and can be passed on to their children, either as cash or as bonds still generating interest.

Of course, as they sell bonds each year, the total investment gets smaller.

So over time, the interest they earn will slowly go down — because 5% of a smaller amount is less money.

But this decline happens gradually, and it wouldn’t be a problem in this case.

Also, the plan is built to last around 25 years, while we only assumed they would need it for 20 years.

That means the slight drop in yearly interest won’t really affect them — the strategy gives them more time than they likely need!

Of course, this is just a simplified example — a way to understand how different strategies might work.

In real life, there are more details to consider: taxes, inflation, healthcare costs, personal goals, and how comfortable someone feels with different types of investments.

These kinds of decisions need to be made based on a person’s full financial picture.

That’s why a proper retirement plan should always be built around the specific situation of each individual or family.

There’s no one-size-fits-all solution — but once you have clarity, the path forward becomes much easier!

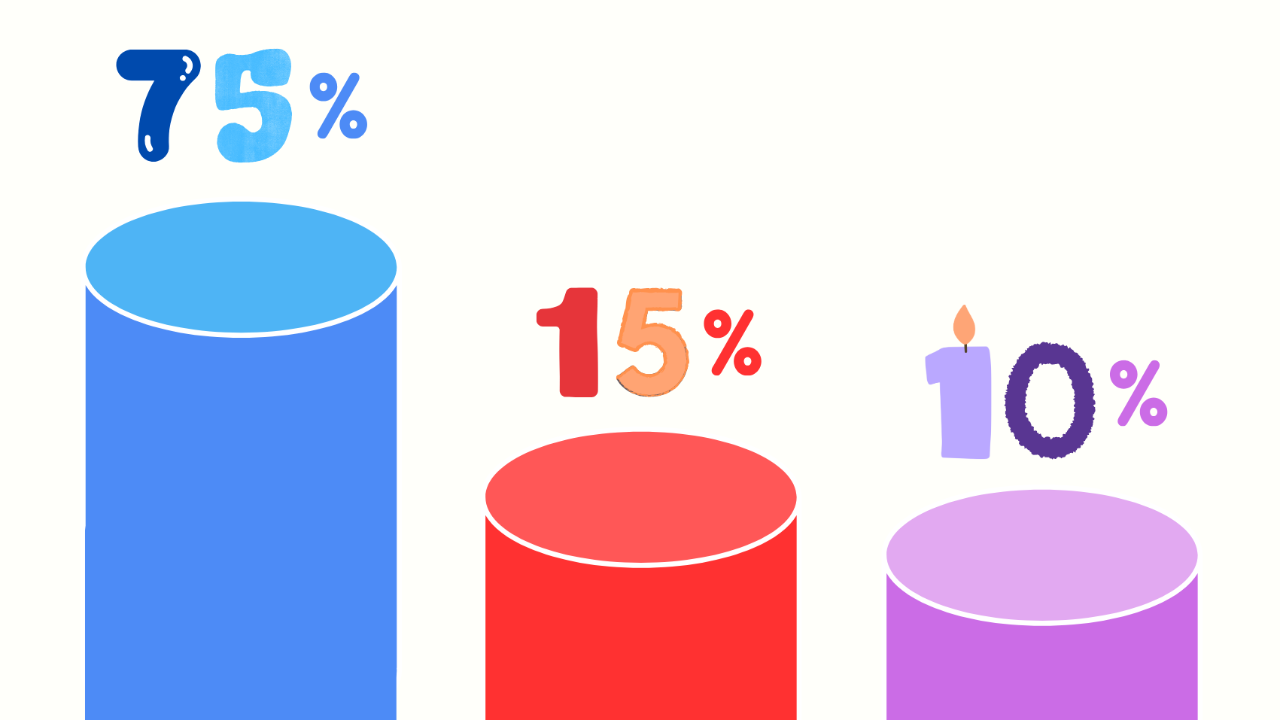

So, note down these three key-points and start investing today:

1. Not investing is the worst choice: Cash loses value over time and won’t last long without growth.

2. Don’t put everything in stocks: The market can crash, and at an older age, recovery is harder.

3. Use bonds for stability: They offer steady income with lower risk, and are a better fit for retirement.