TSI #10: Here is everything you need to know about energy crises

Aug 21, 2022Commodities are considered a hedge against inflation due to their intrinsic value and tend to perform well when prices for consumer goods are on the rise. As expected, when inflation began ravaging the global economy this year, commodity prices spiked. The Russia-Ukraine war didn’t help either.

Oil is still considered the world’s most valuable commodity. Although some businesses would like to give the top spot to data. Let’s look into what happened in the previous energy crises and how you can profit from it.

Why should you care about the energy market?

Imagine you’re barely keeping up with paying the bills when suddenly the energy market pops. Suddenly, you’re paying twice as much for gas and twice as much for heating. Sadly, a large percentage of the world’s population is living on the edge of poverty.

Furthermore, the effects of a global energy crisis impacts industry, production and tourism. Some countries thrive on tourism. I could go on and on but I believe you get the message. It’s bad. But why do such events occur?

The cause behind the turmoil

Most energy crises have been caused by localized shortages, wars and market manipulation. Russia is a major exporter of oil and gas. Following this year’s invasion, most western countries cut ties with them. However, they still needed those precious commodities and had to get them somewhere else. As things were scrambled, the prices went up. Guess who profited from that?

Who profits from that?

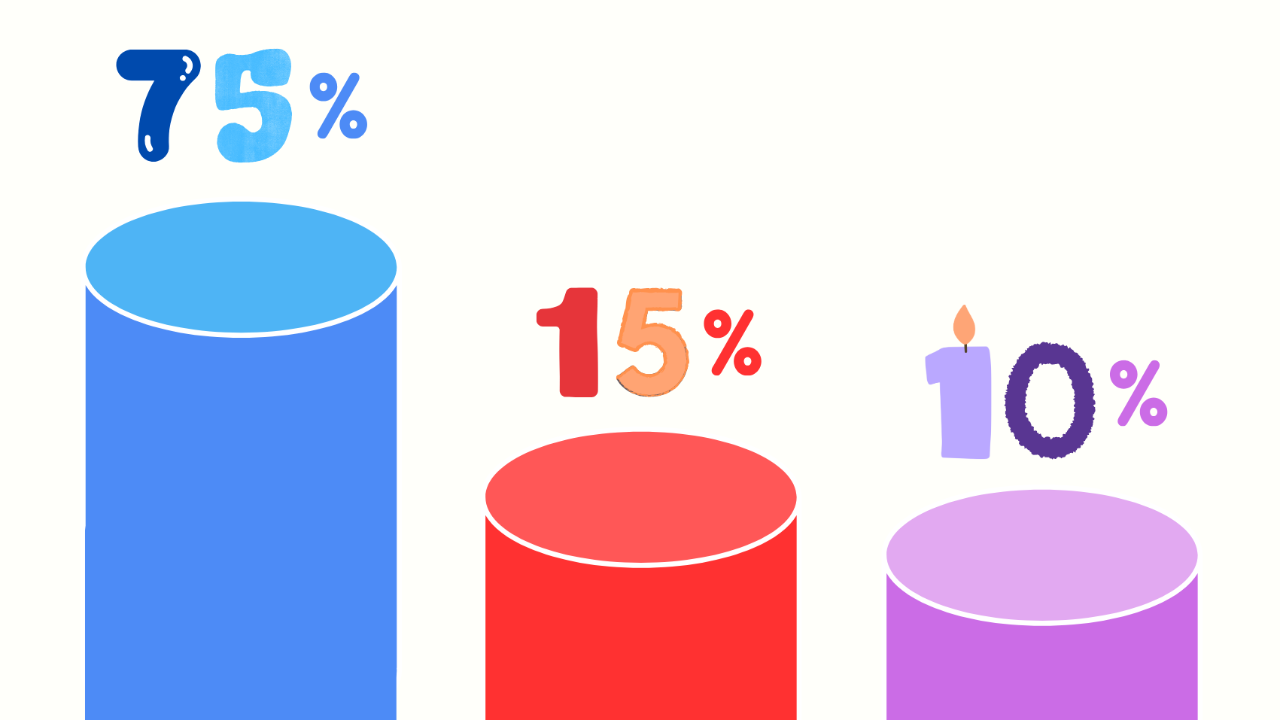

Big Oil made more money than ever in the second quarter of 2022. I would rather show this one with an image. Here is their second quarter profit compared to the same quarter last year.

Should you invest in oil?

Whether you invest in anything at all should not depend on short-term events. If you think the flow of oil will be impaired forever due to Russia’s invasion, then you can consider it. However, if you think things will get back to normal soon, think twice. Here are some insights from history.

Historically, energy shocks calmed down after a few months. In 1973, following the Arab Oil Embargo, oil prices skyrocketed 300%. Chevron (the US oil giant) rose from $2.51 a share to $5.50. The embargo lasted 6 months. As oil went back down, so did CVX shares (back to $2.51). Another famous event. In 1980 when the Iran-Iraq war began. Oil prices expanded and with it the valuation of Chevron. After the dust settled, oil prices began to stabilize and CVX dropped 50% in a year.

Whatever you do in the stock market, make sure it is with a long-term orientation. Short-term movements are impossible to predict.

To Your Financial Freedom,