From One Country to Another: Why Your Broker Might Need to Change

Jun 15, 2025Hello Stoic Investors,

Are you planning to move to the UK (or anywhere else in the world) soon and wondering what to do with your broker?

If the answer is yes, keep reading!

This is a very common question, and it can be a bit confusing. I’m here to help clear things up.

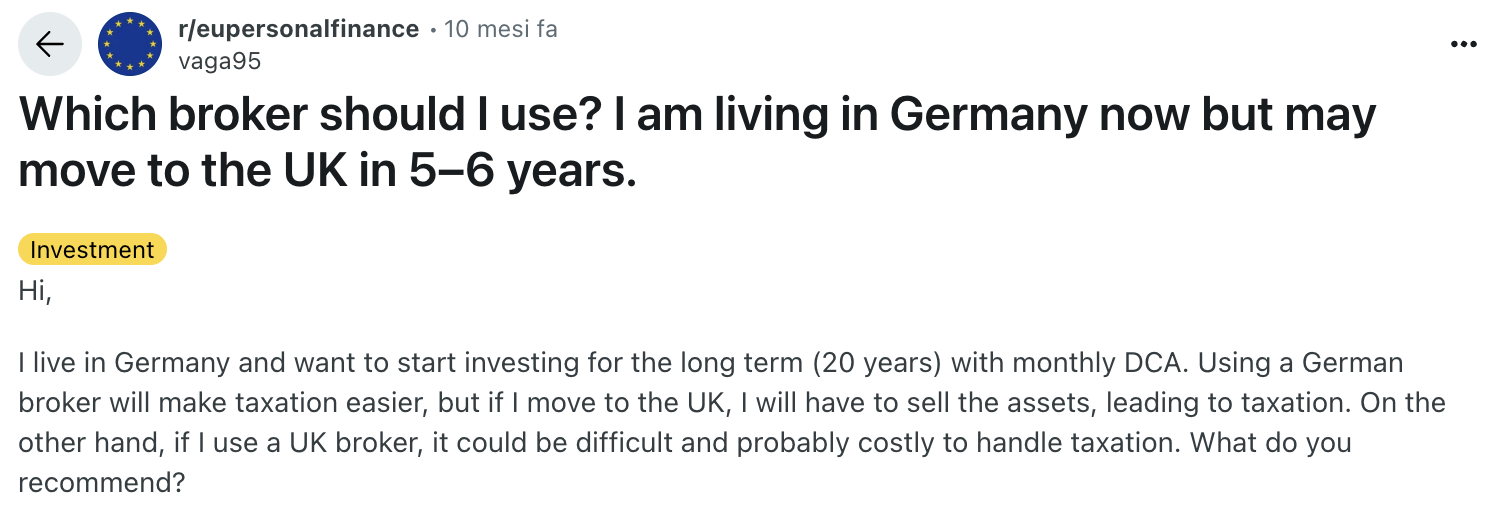

Let me take as an example the situation of someone who posted this on Reddit:

Let’s try to answer their questions and make sure they have the best and smoothest transfer they could wish for!

First of all, if you are not familiar with the term, let’s quickly explain what a broker is.

A broker is a company or platform that helps you buy and sell investments like stocks, ETFs, and other assets.

When you want to invest, you typically need a broker to place those investments on the stock market for you.

Now, for those of my readers who are still in the early stages of their investing journey — perhaps you haven't yet opened a brokerage account or made your first investment — this newsletter can still help!

Whether you’re planning to open a broker account soon or just learning how brokers work, this will guide you in choosing the right one.

Plus, if you decide to switch brokers later, you’ll know what to look for.

Should you switch broker now or later?

The person who wrote the Reddit post asks if it makes sense to keep using their German broker when they move to the UK, or if they should switch to a UK broker before moving.

But first of all:

Is it possible to keep a broker from another country?

And the answer is: Yes, it’s perfectly fine to keep using a broker from another country even after you move.

There’s no rule that forces you to switch brokers just because you’re changing countries.

You can also choose to switch before you move, but there are a few things to keep in mind.

If you keep your German broker while living in the UK:

- Tax reporting: You’ll need to report your investment income to both German and UK tax authorities, which can make tax filing more complicated. The UK tax system will expect you to declare any dividends, capital gains, and other income from your investments.

- Missing out on UK tax benefits: UK brokers offer tax-efficient accounts like the ISA (Individual Savings Account), which are only available through UK brokers. If you keep your German broker, you won’t be able to access these tax benefits.

- Limited access to UK-specific features: Some features and services might be restricted or harder to access once you're living in the UK but using a German broker. For example, you might find that customer support isn’t as responsive or that certain investment options are harder to manage from abroad.

If you decide to switch to a UK broker before you move:

- Account restrictions: Some UK brokers only allow residents to open accounts. If you’re not yet a UK resident, you might not be able to open an account with a UK broker. This could limit your ability to take advantage of UK-specific tax benefits right away.

- Double taxation issues: Switching early might not help much with tax reporting. You’ll still need to deal with the tax rules of both Germany and the UK, as you will be living in Germany but using a UK broker.

Given this, in general, the most efficient approach is to keep your German broker until you move.

Once you arrive in the UK, you can easily switch to a UK broker to simplify tax reporting and take advantage of local tax benefits.

When you make the switch, you’ll also need to transfer your assets to your new broker, and there are a few things to consider when doing that, which we’ll explain next.

What happens when you switch broker?

When you switch brokers, there are two main ways to transfer your investments.

Each method has pros and cons, so here’s what you need to know:

1. In-specie transfer

This means you move your investments directly from your old broker to your new one without selling them.

This is the best option because:

- No tax: You won’t have to pay any tax on the profits you’ve made, as you’re not selling your investments.

- No extra fees: You won’t pay trading fees since you're just transferring the investments.

However, not all brokers offer this option, so make sure to check with both your current and new broker to see if it’s possible.

2. Sell and rebuy

If you can’t transfer your investments directly, you’ll have to sell them first and then buy them again with your new broker.

Here’s what to keep in mind:

- Tax on profits: If you’ve made a profit on your investments, you may have to pay tax in Germany when you sell them.

- Trading fees: You will have to pay fees when selling and rebuying your investments. Be sure to check these fees with both brokers.

In both cases, it’s important to check for any fees that your brokers charge for transferring assets.

Some brokers charge fees for transferring, and if you sell investments, you’ll face trading fees and possibly capital gains tax.

Make sure you’ve checked everything carefully with your current broker and done your research about fees, transfers, and taxes.

This will help make the transfer smooth and avoid any surprises.

How to choose a good UK broker?

When you move to the UK, you’ll need to choose a new broker.

Here’s what to look for in a UK broker:

1. It’s easy to use

You’ll be investing a lot of money over time, so you want a platform that’s easy to understand and use.

You don’t want to waste time trying to figure out how to use it.

You can use comparison sites like brokerchooser.com to find one that works for you.

2. It’s safe

Your broker needs to be regulated and have a good reputation.

This means they follow the rules and your money is protected.

You should also do a quick Google search to see if the broker has been involved in any problems or scandals.

3. It’s cheap

Brokers charge you in different ways:

- Subscription fee: some brokers charge a monthly fee just to use the platform.

- Per trade fee: you pay a fee each time you buy or sell an investment.

- Asset fee: some brokers charge a percentage of your total investments every year.

Be careful with zero fee brokers.

While they advertise no fees, they might make money in hidden ways that are harder to spot, like giving you worse prices when you buy or sell.

Here are 4 brokers that are popular with my students, especially beginners:

- FreeTrade: simple and easy to use.

- Trading 212: no commissions, flexible.

- InvestEngine: great for long-term investors, low fees.

- Interactive Brokers: good for more experienced investors with large portfolios.

Each of these brokers is safe and regulated in the UK, and they offer simple platforms to get started with investing.

These are general guidelines for when you’re planning to move to the UK and switch brokers.

Of course, every situation is different, so it’s important to consider your specific circumstances.

Your personal tax situation, the type of investments you hold, and the brokers you use all play a role in how you should handle the move and switch.

So, note down these 3 Q&A and start investing today:

1. Should I switch to a UK broker now or later? Switch to a UK broker once you move to the UK to make tax and investment management easier;

3. What happens when I switch brokers? You can either transfer your assets directly without selling or sell and rebuy your investments; each method has different tax and fee considerations;

3. How do I choose a good UK broker? Look for a broker that is easy to use, safe, and has clear, affordable fees. Avoid "zero fee brokers" that might charge hidden costs.