From Zero to Millionaire - The Definitive Guide to Building Wealth in Today's World

May 28, 2023Hello Stoic Investors,

Today I want to talk about the ultimate dream. How to become a millionaire.

I’ve spent thousands of hours learning about the world’s most successful people.

There are only two ways to become a self-made millionaire.

A: Build a business

B: Stack assets

While they do have their differences, one thing binds them.

Value.

Business owners become millionaires if they solve valuable problems at scale.

Investors become millionaires if they acquire valuable assets.

But how do you identify value?

Let’s look at this from both perspectives.

Building an unbeatable business

Identifying a valuable business opportunity requires a combination of creativity, market awareness, and due diligence.

Industry, timing, competition, trends, risks, partners, etc. are just a few things a business owner needs to manage.

The learning curve is big but so are the results.

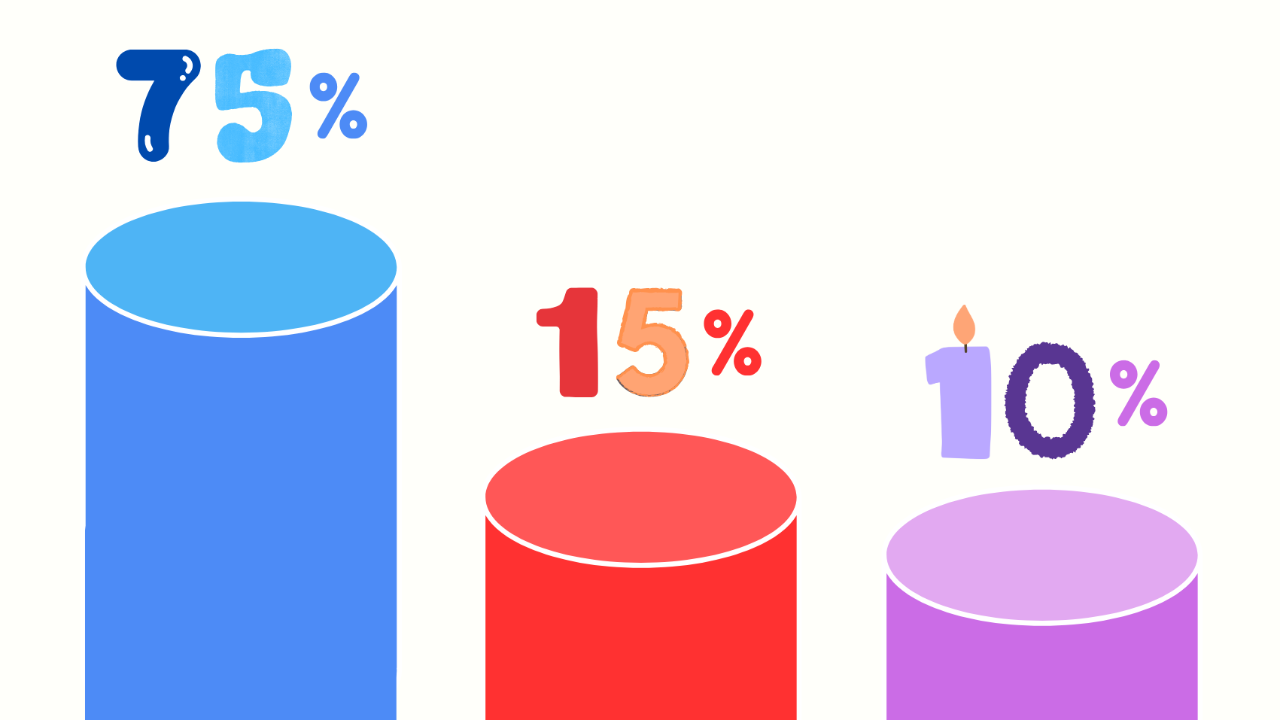

A survey by Fidelity Investments found that 55% of millionaires are business owners!

But there are some that identified an “easier” path.

A path that doesn’t require you to constantly be present and active.

Investing your way to $1,000,000

The investor’s path doesn’t require much of your energy if done properly.

Emphasis on properly.

Good investors find trending investments and sell them when they rise in price.

Great investors find valuable investments and hold them.

The real value lies in the durability of the asset.

A house that can host a family for +50 years is more valuable than a house that could fall apart in 5 years.

Here is some data to back that up.

A survey conducted by financial services firm UBS found that 80% of millionaires invest in the stock market,

with a majority of them favoring a long-term buy-and-hold strategy.

So when you’re searching for investments, make sure you’re investing in things that will hold value.

Let me give you a leg up.

Five durable investment options

Index Funds:

Investing in index funds can provide diversification across multiple asset classes and lower fees compared to actively managed funds. However, you will have to withstand volatility, which can be gut-punching sometimes.

Real Estate:

Investing in real estate can provide rental income and potential long-term appreciation. However, it requires significant capital investment, may involve maintenance costs and market risk, and may be subject to economic cycles.

Renewable Energy:

Investing in renewable energy can provide a long-term income stream from renewable resources and help reduce carbon emissions. However, it requires high capital investment, may be subject to government regulations and subsidies.

Technology:

Investing in technology can provide growth potential and high returns. However, it involves high volatility and may be subject to rapid technological changes and market disruption.

Precious Metals:

Investing in precious metals can provide a hedge against inflation and economic uncertainty. However, it may involve storage costs, fluctuating prices, and may not generate income.

Whatever you invest it, just make sure you follow this absolute quote.

“Know what you own, and know why you own it.” - Peter Lynch

So, note down these points and start building wealth today:

- Business owners become millionaires if they solve valuable problems.

- Investors become millionaires if they acquire valuable assets.

- The real value lies in the durability of the asset.