Everything You Need To Know About Dividends

Jun 25, 2023Hello Stoic Investors,

Today I want to talk about dividends – a popular passive income source.

Dividends are awesome.

If you’re new to investing, dividends are payments made by a corporation to its shareholders as a

distribution of the company's profits.

When a company generates earnings, it may choose to allocate a portion of those profits to reward its

shareholders (people who own the stock).

For example, if a company declares a dividend of $0.50 per share and an investor owns 100 shares, they

would receive $50 in dividend payments.

If you spend time on social media, you've likely seen how amazing dividends can be.

Some call it "the ultimate passive income source".

But that’s when the taxman comes.

Before you jump into that, I think it would be beneficial to review the pros and cons.

The pros and cons of dividend investing

Pros of Dividend Investing

Passive Income: Dividend investing can provide a steady stream of passive income, as companies share a portion of their profits with shareholders.

Potential for Growth: Companies that consistently pay dividends tend to be financially stable and well-established, offering the potential for long-term capital appreciation.

Dividend Reinvestment: Dividends can be reinvested to purchase additional shares, compounding returns over time and potentially accelerating wealth accumulation.

Lower Volatility: Dividend-paying stocks often exhibit lower price volatility compared to non-dividend-paying stocks, providing more stability during market downturns.

Hedge Against Inflation: Dividends have the potential to keep pace with or exceed inflation, helping to preserve the purchasing power of invested capital.

Cons of Dividend Investing

Limited Growth Opportunities: Companies that prioritize dividend payments may reinvest fewer profits into growth initiatives, which could hinder their ability to expand or innovate.

Dividend Cuts or Suspensions: During economic downturns or financial hardships, companies may reduce or eliminate dividend payments, impacting income expectations.

Dividend Taxation: Dividend income is typically subject to taxation, potentially reducing the overall return on investment.

Limited Exposure to Growth Stocks: Dividend-focused portfolios may have less exposure to high-growth stocks that reinvest profits for expansion, potentially missing out on substantial capital appreciation.

Dividend Yield Trap: High dividend yields may be enticing but could be a sign of underlying issues within a company, such as declining financial health or unsustainable payout ratios.

Now that you know a little bit about dividends, let me point out the biggest issue.

It’s difficult to escape taxes on dividends.

When it comes to how dividends are taxed, it depends on the country you live in.

Let's look at simplified example for the US.

When it comes to dividends in the United States, there are two main types:

Qualified dividend and Ordinary dividends

Qualified dividends: are a special type of dividend that gets taxed at lower rates.

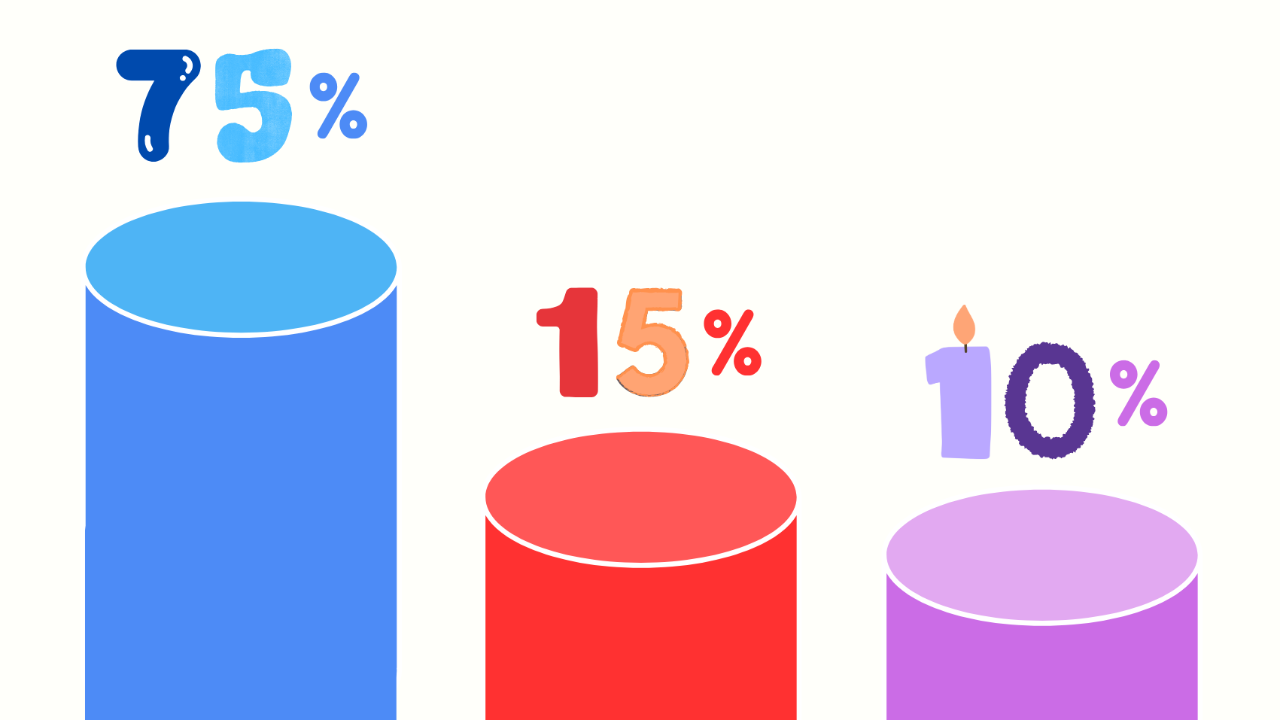

Let's say you own shares of Company X, and during the tax year, you receive $100 in qualified dividends from those shares. If you are in the 15% tax bracket, the tax rate for qualified dividends, the tax on these dividends would be 15% of $100, which equals $15. So, after taxes, you would keep $85.

Ordinary dividends: are the regular dividends you receive from your investments that do not meet the specific criteria to be considered qualified.

Now, let's consider you also own shares of Company Y, and during the tax year, you receive $100 in ordinary dividends from those shares. If you are in the same 15% tax bracket, but since these are ordinary dividends, they are taxed at your regular income tax rate. Let's say your regular income tax rate is 22%. In this case, the tax on these dividends would be 22% of $100, which equals $22. So, after taxes, you would keep $78.

If you don’t want to deal with the hassle of figuring out your dividend taxes, here is a pro tip for you.

Buy dividend paying assets inside your tax-advantaged accounts.

So, note down these points and start investing today:

1. Dividends can be one of the best passive income sources

2. But you need to be smart around taxes

3. Dividends can be taxed as qualified or ordinary