Don’t Get Stuck in the AI Bubble Before It Pops

Nov 23, 2025Hello Stoic Investors,

Today I want to talk to you about something super timely — something that might not seem important to everyone or feel like it affects your own situation, but it’s worth paying attention to because it could have broader effects on the market.

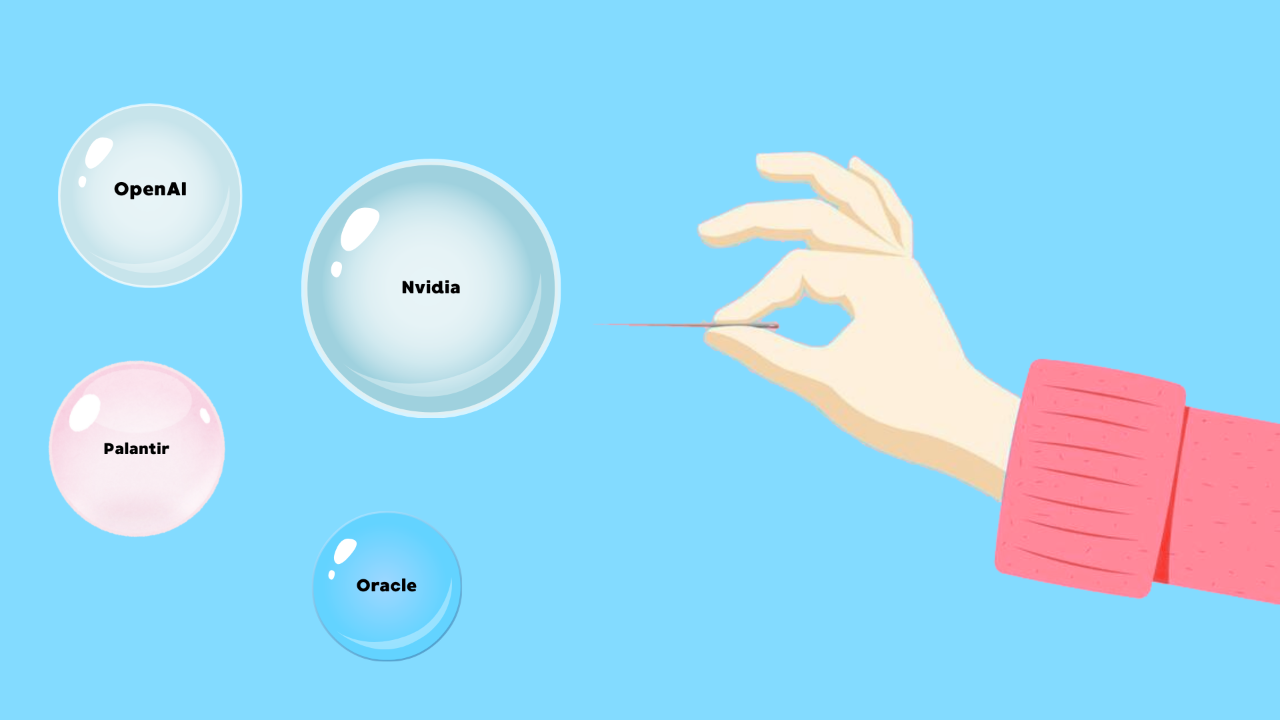

In the past weeks, you may have seen people on social media or in the news talking about an “AI bubble” and how it could seriously affect the stock market and the economy.

But what does that really mean?

To put it simply, it’s about how some AI companies make themselves look more successful than they actually are.

Here’s what’s been happening over the past months:

Big tech companies, AI giants, and fast-growing startups have been passing the same money around.

They invest in each other, buy services from one another, and rely on these transactions to appear stronger and growing faster than they really are.

This makes the numbers — like revenues and demand — look higher, and the whole AI industry seem “unstoppable,” even if part of that growth is just money moving in circles between companies.

The problem is that these inflated expectations may not match reality.

If growth slows down or investors realize that the numbers were exaggerated, confidence can vanish quickly.

When many investors sell at the same time, it can trigger a sudden drop in stock prices — in other words, a market crash.

What is a Market Crash?

A market crash happens when stock prices or other investments drop quickly and by a lot.

This can happen because of panic selling, bad news, or big changes in the economy.

In the case of the AI bubble, the “bad news” could be slower growth, disappointing results, or the hype fading away.

While it might feel like a big problem, it’s just a normal part of the market.

Crashes often happen when prices are too high compared to the actual value of companies or assets — exactly what can happen in the AI bubble.

The hype and inflated numbers make these companies look more valuable than they really are.

Eventually, these high prices can’t stay, and the market drops fast.

If you can spot the signs early, you’ll be better prepared. Understanding whether the market is overvalued is the first step to being prepared.

Even though the AI bubble is a specific case, the way to check if the market is overvalued doesn’t change.

You can still use simple tools and indicators to see whether prices are too high and a market crash might be more likely.

Here’s how:

Step 1: Check the overall market valuation

Open Google and search for CurrentMarketValuation.com.

This website gives an easy-to-understand view of whether the market is overvalued or undervalued. It’s a simple first step to see if prices, in general, are higher than they should be.

Step 2: Look at 3 key indicators

Here are three indicators that help spot an overvalued market:

- The Buffett Indicator: Compares the total value of all stocks to the size of the economy (GDP). If this ratio is much higher than usual, the market may be overvalued.

- The S&P 500 P/E Ratio: Shows how much people are paying for a company’s earnings. High numbers suggest the market is overvalued.

- Mean Reversion: Compares current prices to their long-term averages. If prices are far above the average, the market is overvalued.

Even in the case of the AI bubble, these indicators help you understand if the hype has pushed prices too high.

Spotting overvaluation early can make it easier to protect your investments before a market crash.

How to Prepare for a Market Crash

So what should you do as a beginner investor to protect and grow your money?

First, don’t chase hype.

If a stock has doubled in just a few months because of excitement around AI or other trends, you’re already late. Buying now can be risky if the price drops suddenly.

Second, focus on a long-term, balanced approach.

Here’s what I’d do instead:

-

60% in global ETFs (SWDA + XMMS):

These ETFs give you exposure to more than 2,500 companies from all over the world — not just one country or one sector.

This means your money is spread out: if one industry (like tech) has a bad year, the rest of your portfolio helps keep things stable.

It’s a simple way to get instant diversification without needing to pick lots of individual stocks.

-

4% in individual stocks:

I keep 6–10 stocks max, each representing about 4% of the portfolio.

This keeps things easy to manage and prevents a single mistake from hurting you too much.The idea is: big enough to benefit if a stock performs well, but diversified enough to protect you if one goes wrong.

And I only pick companies I truly understand — not hype, not trends, just businesses I can explain clearly.

-

Keep cash ready:

Don’t rush to invest everything.

Markets don’t warn you before they drop — corrections happen fast.

Having cash available means you can buy strong companies or ETFs at lower prices instead of panicking and selling.

Cash acts like a safety cushion: it gives you flexibility and helps turn market drops into opportunities instead of problems.

This strategy helps you stay calm during market swings, including any effects from the AI bubble, and ensures your money is still working for you while reducing risk.

In summary: the AI bubble shows how hype and money moving between companies can make growth look bigger than it really is.

If reality doesn’t match expectations, confidence can drop quickly, which may trigger a market crash. But by understanding the risks and having a simple plan, you can protect your money and stay prepared.

So, note down these 3 key pieces of information and be prepared today:

1. AI Bubble: Some AI companies appear more successful than they really are because of hype and internal investments.

2. Market Crash: A sudden drop in stock prices can happen when expectations don’t match reality.

3. How to Prepare: Don’t chase hype, focus on long-term investments like global ETFs, keep small positions in stocks, and have cash ready to buy opportunities.