TSI #44: How to predict a stock market crash

Apr 30, 2023Hello Stoic Investors,

Today I want to focus on something super important. Crashes.

The fear of a stock market crash is something that can keep even the most experienced investors up at night.

But how can you predict a stock market crash?

Unfortunately, there's no crystal ball that can tell you when a crash will happen.

However, you can watch out for warning signs. Let’s go over two.

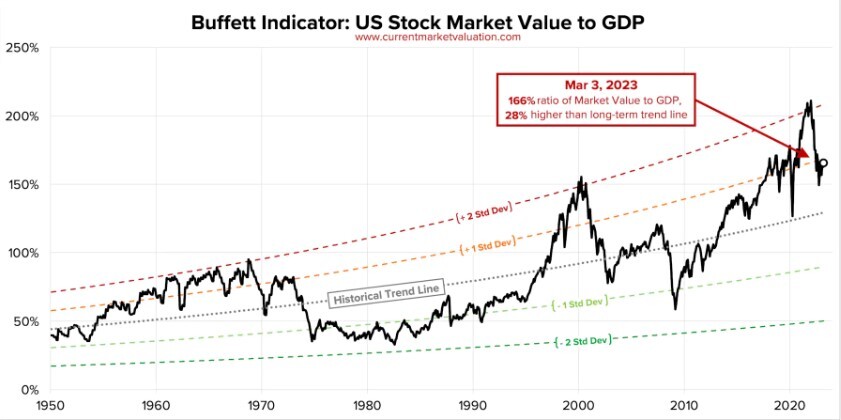

The Buffett Indicator

Named after the famous investor Warren Buffett, this ratio compares the total market capitalization of all publicly traded companies in a country to the country's GDP.

When this ratio is high, it suggests that the stock market is overvalued compared to the country's economic output. The following image shows the current situation.

Price-to-earnings (P/E) ratios

The P/E ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio indicates that investors are willing to pay more for each dollar of earnings.

If the P/E ratio of the overall market or individual stocks is much higher than their historical average, it could indicate that they are overvalued.

Other indicators

A few other indicators exist such as the dividend yield trend, interest rates, mean reversion, etc.

But I don’t want to confuse you with those. Two is enough.

If both of them are screaming danger, then you might want to apply a bit of extra caution.

Nevertheless.

Even if all the warning signs are there, you can’t time the crash.

What is expensive can always get more expensive.

That’s why the best investors never forecast anything.

Instead, they evaluate the situation. Think long and hard. And then prepare for all possible scenarios.

Active investors do that by being more aggressive or defensive.

Long-term passive investors (those that mostly own index funds and diversified ETFs) don’t have to do that.

There is a much simpler way.

When the market is down, buy as much as you can.

When the market is up, stay the course.

Simple and effective.

So, note down these points and start investing today:

- The Buffett indicator and the P/E ratio help estimate if stocks are overvalued

- But you can never time the crash

- Long-term investors don’t have to fear crashes