"Things are Better when done Together"... and Investing is No Exception!

Sep 21, 2025Hello Stoic Investors,

Today, I want to talk about a very relevant and common topic:

How to manage finances as a couple?

Managing your finances together can indeed be challenging, because you need to coordinate goals, habits, and priorities with another person.

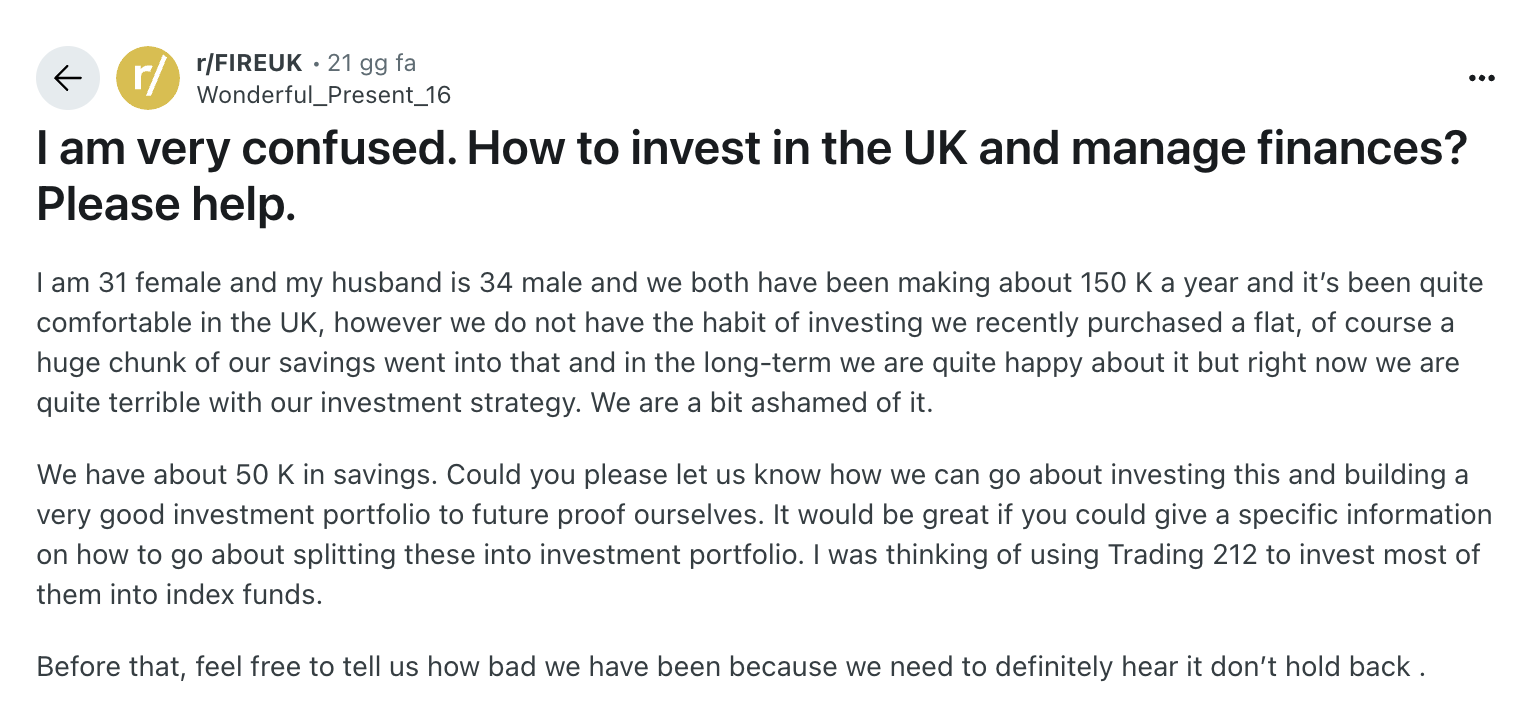

So here’s the post we’ll be responding to:

First of all, there’s nothing to be ashamed of, guys.

Managing money is never easy, and it can feel even more complicated when you’re trying to do it together.

Instead of focusing on “how bad you’ve been” as the post jokingly suggests, I’ll show you how to build a safe and solid portfolio together for the long term.

So these are the three steps I consider essential:

Step 1: Make the Most of Your ISA

An ISA (Individual Savings Account) is a tax-free account that allows your money to grow without paying tax on any interest, dividends, or capital gains.

Each person in the UK has a total annual ISA allowance of £20,000, which applies across all ISA types.

This means you cannot exceed £20,000 per person per year, no matter how many ISAs you open.

The account you absolutely want to open first is a Stocks & Shares ISA.

This is ideal for long-term investing.

You can invest in a global ETF, such as SWDA, which spreads your money across thousands of companies worldwide.

Historically, global markets have returned around 10% per year, providing steady growth while remaining low-maintenance.

Because an ISA is individual, both you and your husband will need separate accounts.

This allows each of you to fully use your £20,000 allowance per year, giving you flexibility to invest for the long term.

Another account you could consider is a Cash ISA, especially if you want to create an emergency fund.

A typical emergency fund covers 3–6 months of household expenses; for example, if your monthly spending is around £4,000, you want an emergency fund of £12,000–£24,000.

Important: any money put into a Cash ISA counts toward your £20,000 allowance!

So, if you have both accounts, you need to allocate your allowance between Stocks & Shares ISA and Cash ISA to stay within the limit.

The ISA allowance resets every tax year, so next year you can allocate a new £20,000 per person as you wish.

Step 2: Build Your Pension with a SIPP

Once you’ve made the most of your ISA allowances, the next step is to focus on your pension using a SIPP (Self-Invested Personal Pension).

A SIPP lets you invest for retirement tax-free, and the government adds a 20% bonus on every contribution.

For example, if you contribute £800, the government tops it up to £1,000.

Higher-rate taxpayers can also claim additional tax relief through self-assessment.

Each person has an annual SIPP contribution limit of £60,000, or up to their total annual income — whichever is lower.

With a £150,000 salary each, both of you have plenty of room to invest for retirement while benefiting from the government bonus.

Inside your SIPP, you can invest in the same type of ETF you use in your Stocks & Shares ISA, such as a global ETF like SWDA.

This keeps your portfolio simple and aligned with your long-term investment strategy.

Step 3: Let Your Money Grow

After contributing to your ISAs and SIPPs, the most important step is to let your money grow over time.

By contributing consistently and keeping your investments in low-cost global ETFs, your portfolio can grow significantly thanks to compounding, where your earnings generate their own earnings.

Over the long term, your combined investments in ISAs and SIPPs can build a substantial portfolio.

Once your investments reach a size that matches your goals, you can withdraw a small, sustainable percentage each year as passive income without risking the core of your investments.

The exact percentage depends on your future spending needs and the total value of your portfolio, so it’s flexible and can be adjusted as your circumstances change.

Putting It Into Practice

To give you a practical example, let’s look at how you could allocate your money.

Of course, I don’t have all the details about your exact situation, so we’ll start with the following assumptions:

- Annual salary: £150,000 each

- Savings: £50,000

- Monthly household expenses: £4,000

- Monthly investment capacity: £2,000 per person

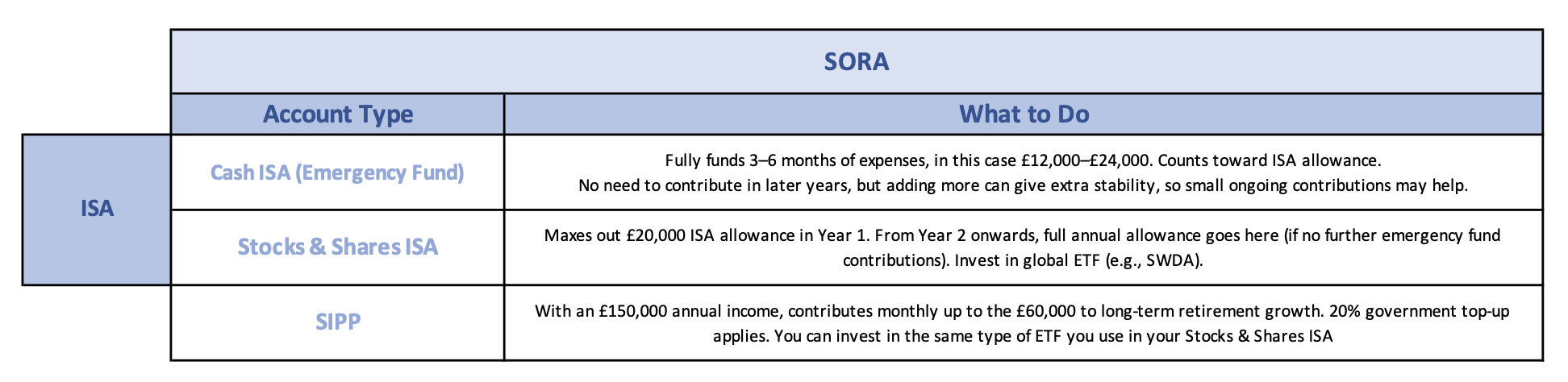

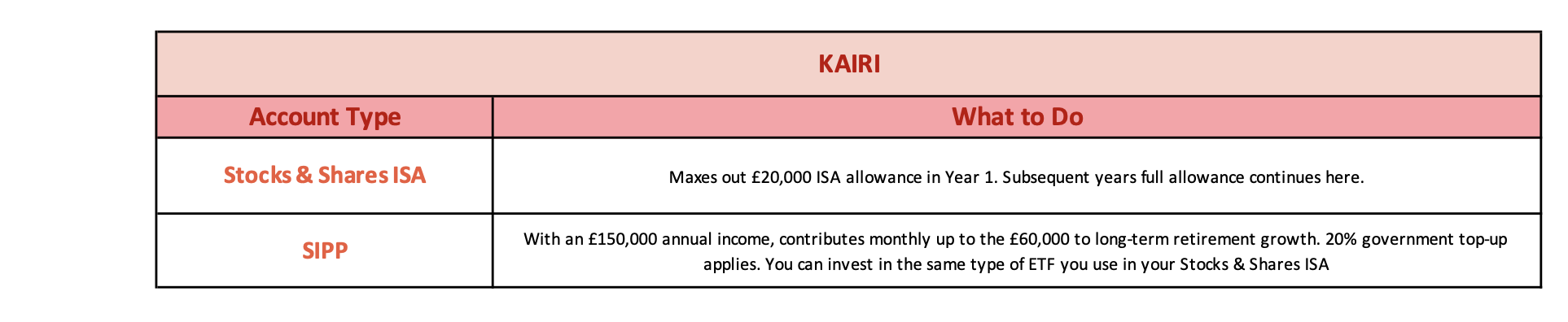

So, let’s imagine — and since I don’t know your real names, I'll call you Sora and Kairi (from my absolute favorite video game) — how your accounts could be set up:

1. Sora: Has a Stocks & Shares ISA and a Cash ISA for the emergency fund, plus a SIPP

2. Kairi: Will contribute to her own Stocks & Shares ISA and SIPP (technically she could contribute to Sora’s Cash ISA too, but for the sake of this example, we’ll keep it simple)

Regarding the approach to use your monthly investment potential (£2,000 per month) and savings (£50,000), it depends on your personal characteristics:

- Spread contributions: By spreading your contributions over the year, you can average your entry and reduce the psychological impact of a large initial payment.

- Lump sum approach: The advantage of investing all at once is that your money starts working immediately, but it depends on your personal risk tolerance; it can be stressful if the market drops.

Of course, this is just a basic framework.

There are many other factors to consider if you want to create a fully tailored financial plan that fits your specific needs, goals, and circumstances, but this is a good starting point!

So, note down these three key - things and start investing today with your significant other:

1. ISA: you can invest up to £20,000 per year across all ISA types. Put this money in a low-cost, globally diversified ETF (e.g., SWDA) for long-term growth;

2. SIPP: you can contribute up to £60,000 per year or total annual income (whichever is lower). Invest in the same global ETF as your ISA to keep your portfolio simple;

3. Emergency Fund: cover 3–6 months of household expenses, usually kept in a Cash ISA for safety and easy access.