The Most Anticipated New Stock Listings Of 2023/2024

Oct 29, 2023Hello Stoic Investors,

Today I want to talk about new stocks.

Smart money attracts investors.

Dumb money attracts gamblers.

According to a Nasdaq analysis of companies that have gone public since the 1980s, the IPO success rate

is about 20%.

But those 20% that do succeed, produce an enormous amount of return on investment.

If you’re new to investing, an IPO is like a company's "coming out" party. It sells shares to the public for the

first time.

So, let’s take a look at some of the most important IPOs that may happen in 2023/2024.

Most anticipated IPOs

Stripe IPO (Valuation: $50 Billion):

Despite a valuation drop from $95 billion in March 2021, Stripe raised $6.5 billion in March 2023. It plans to use the funds for stock buybacks and covering tax bills. Despite the valuation reduction, some investors remain optimistic about a Stripe IPO, given the rising demand for e-commerce.

Klarna IPO (Valuation: $6.7 Billion):

Klarna, a Swedish buy-now-pay-later pioneer, faced an 85% decline in valuation from almost $50 billion within a year. The reduced valuation is due to concerns about profitability.

Chime IPO (Valuation: $25 Billion):

Chime, a fintech mobile banking platform, was valued at $1.5 billion in 2019 and reached $25 billion in 2021. IPO plans were put on hold due to market uncertainty.

Databricks IPO (Valuation: $33 Billion):

Databricks, a big data and AI analytics provider, had a valuation of $33 billion in October 2022, down from $38 billion in August 2021. It's focusing on AI and data initiatives.

Reddit IPO (Valuation: $5.5 Billion):

Reddit's valuation decreased from $10 billion, mainly due to a tech IPO slowdown. It's waiting for a better market environment before going public.

Impossible Foods IPO (Valuation: $7 Billion):

While plant-based food company Impossible Foods plans to go public, CEO Peter McGuinness suggested it might not happen in 2023 due to market conditions.

Better.com IPO (Valuation: $7.7 Billion):

Mortgage lender Better.com is reevaluating its $8 billion IPO deal amid challenges in the housing market and issues related to misleading investors.

A word of warning

Many folks get excited thinking about what they could've earned if they invested in a company years ago.

But they often overlook how many new companies didn't make it.

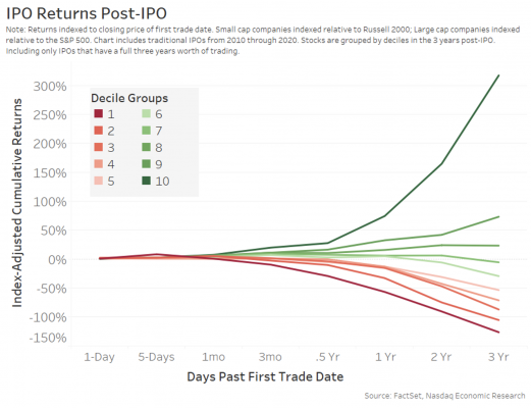

Here is some data to back it up.

Here is some more data for you. According to Forbes, between 1975 and 2011, over 60% of newly public

companies saw negative returns after five years.

So, if you do invest in IPOs, know that they carry a lot of risk.

So, note down these points and start researching today:

1. The the IPO success rate is about 20%.

2. Over 60% of newly public companies saw negative returns after five years

3. Top upcoming IPOs: Stripe, Chime, Klarna, Databricks