Are Target Date Funds good?

Nov 19, 2023Hello Stoic Investors,

Today we're talking about saving for your retirement.

Have you ever heard of Target Date Funds?

When we save money for retirement, there are many ways to do it.

Target Date Funds are a way to do that with a good degree of automation.

Imagine a basket of investments that automatically gets safer as you get closer to retirement.

That's the basic idea behind Target Date Funds.

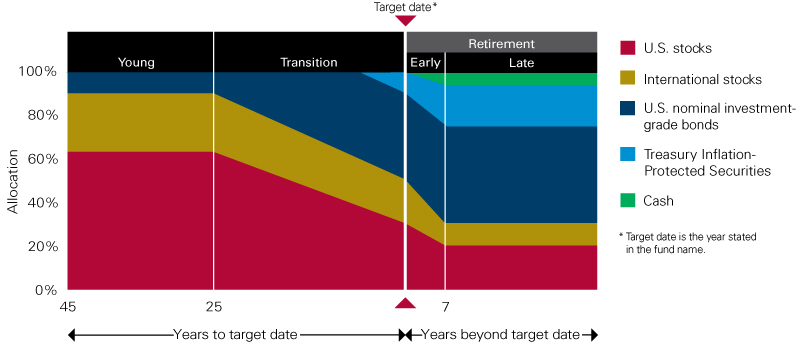

They start off aggressive (more stocks) and get more conservative (more bonds) as you approach your

desired retirement year.

Two Limitations of Target Date Funds

However, even if Target Date Funds might seem like a simple choice, there are a couple of important

drawbacks to consider before you decide they're right for your retirement plan.

1. Uncertainty in Retirement Timing

Are you really able to tell the exact year in which you will stop working?

Life can be full of surprises. Target Date Funds pick a year for you, but what if your plans change?

You may need to adjust your retirement plan in a hurry.

2. Vulnerability During Economic Downturns

These funds are supposed to keep your money safe as you get older.

But when you need them the most, they might not do a good job, for example during recessions like in 2008

and 2022.

With a Target Date Fund, you would still have lost between 15% and 25%!

Which is crazy, considering that the whole point of these would be to keep your money safe.

So, what's a smarter way to prepare for retirement?

Make your own plan.

Don't just pick a retirement year and forget it, change how you invest based on your own financial goals and

how close you are to them.

For example, consider to use Gold to actually diversify your investments.

Remember, Target Date Funds, while appealing for their simplicity, may not be the safest bet for your

retirement.

So, note down these points and start investing today:

1. Target Date Funds start off aggressive and become more conservative the closer you get to

retirement

2. However, they don't really protect you during recessions

3. Consider to include gold as a way to diversify for your retirement portfolio