5 Essential Investment Questions for Beginners

May 04, 2025Hello Stoic Investors,

Today, I want to speak to anyone who feels completely lost when it comes to money and investing.

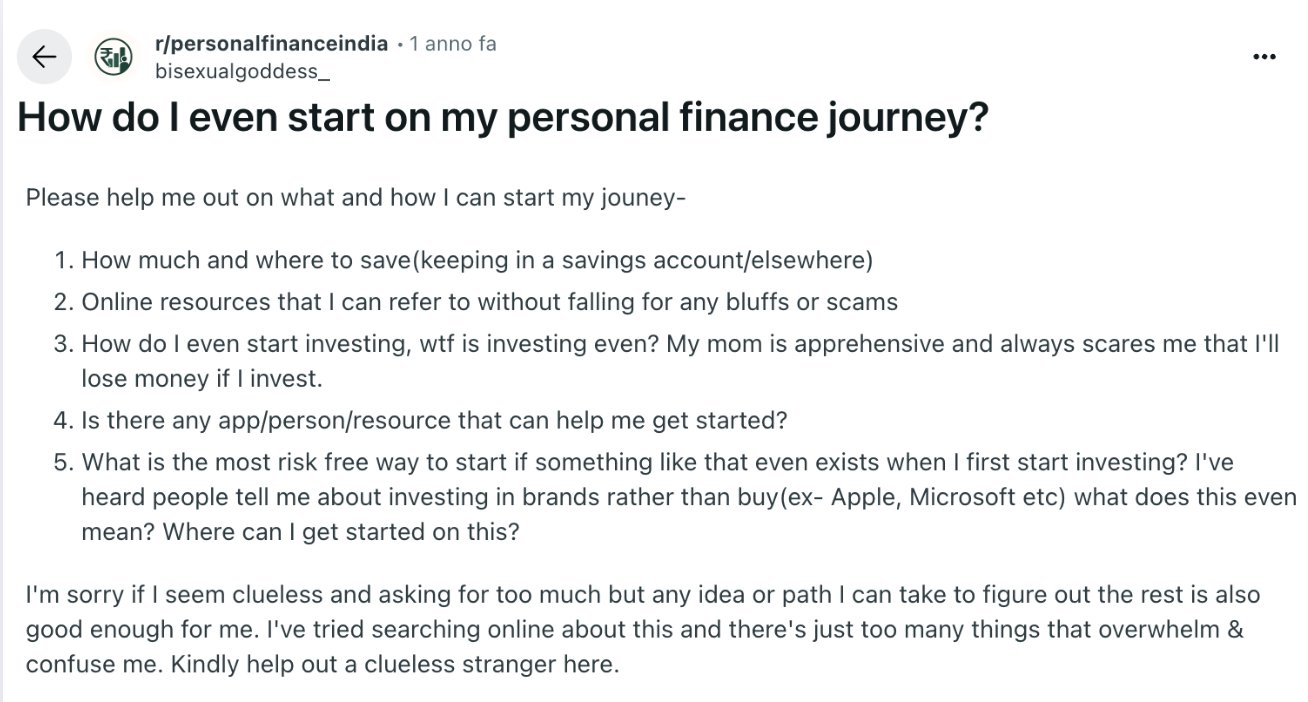

I came across a Reddit post that asked the kind of honest, simple questions most people are afraid to say out loud.

Here's the post:

Let’s walk through the questions one by one:

1. How much and where to save?

Before you invest a single pound, you need what we call an Emergency Fund.

That means putting aside enough money to cover 3 to 6 months of your basic expenses, like rent, food, and bills — just in case you lose your job or your car breaks down.

Where should you keep this money?

In a high-interest savings account.

Let me explain that:

A savings account is a place where you store money, separate from your main current account.

A high-interest account means the bank pays you a little bit of money — called “interest” — just for keeping your savings there. It’s like a reward for not spending it.

The interest helps it grow slowly and safely — without taking risks.

Once your emergency fund is sorted, that’s when you can think about investing.

2. Are there online resources that are safe and not scams?

Yes, and it’s smart to be cautious. A lot of websites or influencers make big promises… but they just want your money.

Here are a few trustworthy, safe and free resources:

- JustETF: This website helps you explore ETFs — which are simple investment funds (I’ll explain later). You can search, compare, and understand how they work.

- Morningstar: A well-known research site where you can look up investment funds and stocks, check their past performance, risk level, and what companies are inside.

- Investopedia Simulator: This is like a video game for investing. You can buy and sell “pretend” investments with fake money — so you can learn how things work without the risk of losing real money.

If something looks too good to be true (like “double your money in a week”), it’s probably a scam.

Real investing is boring, slow, and smart.

3. How do I even start investing? What is investing?

Investing means using your money to buy things that can grow in value over time.

Instead of just keeping your money in a savings account, you’re buying pieces of businesses, or funds, or property — things that (hopefully) become worth more in the future.

Most people invest in the stock market. That’s where companies like Apple, Google, and Tesco let you buy a small piece of their business — called a share or stock.

For example, if you buy £100 of Apple shares, and Apple grows, your £100 might become £120, or £150, or more over the years.

But investing is not gambling — it’s long-term. Yes, prices go up and down, but history shows that if you invest in strong, global companies and wait patiently (think 10+ years), you’re very likely to make a good return.

Your mum is worried you’ll lose money — that’s normal. Parents want us to stay safe.

But keeping all your money in cash for the next 30 years is also risky — because inflation (prices rising every year) slowly eats your money’s value.

That’s why smart investing actually protects your future.

4. Is there any app/person/resource that can help me get started?

This is exactly what we’re here for.

Our mission is to help people who’ve realized that investing is no longer optional — it’s essential if you want to take care of your future.

We want to make it possible for you to do that independently, without needing a financial advisor, and without feeling lost or overwhelmed.

And most importantly — no promises of becoming a millionaire overnight.

The best approach is long-term, because we’re all busy people with real lives, and we don’t have time to watch the markets or trade all day.

5. What is the most risk-free way to start? And what does “invest in brands like Apple or Microsoft” mean?

There’s no such thing as zero risk.

But some ways of investing are much less risky than others — especially if you do it slowly and sensibly.

One of the safest ways to start is to invest in ETFs.

An ETF (Exchange-Traded Fund) is like a basket full of companies.

For example, instead of buying just 1 share of Apple, an ETF might own 1,500 different companies — Apple, Microsoft, Amazon, Nestlé, Toyota, and so on.

So if one company goes down, the others can help balance it out. That’s called diversification — and it’s key to reducing risk.

Here are some examples of the most well-known ETFs you might have heard of:

- SWDA – iShares MSCI World: tracks stocks from 23 developed countries worldwide

-

VUSA – Vanguard S&P 500: tracks the performance of the 500 largest companies in the U.S.

These are passive funds — they don’t try to “beat the market”, they just track it.

That means low fees, less stress, and often better results over time.

The hardest part is starting.

But if you read this far, you’re already ahead of 95% of people.

And just to be clear — everything I’ve shared here is general advice that can help many beginners get started.

But of course, everyone’s situation is different.

To build a proper financial plan, you’d need to look at your specific goals, how much you earn and spend, how long you want to invest for, and how comfortable you are with risk.

This is just a starting point — not a personalised plan!

So, note down these 5 Q&A and start investing today:

1. How much and where to save? Save 3–6 months of expenses in a high-interest savings account;

2. Where to learn safely? Use sites like JustETF, Morningstar, and the Investopedia Simulator to learn and test without risk;

3. What is investing, really? It’s buying things that grow over time — to protect your money from inflation and build wealth for the future;

4. Is there a place to get started? Yes — this is exactly our mission: helping people invest independently, without hype or financial advisors;

5. What’s the safest way to begin? Start by researching ETFs to build a long-term strategy with consistent, diversified investments.