30 Ways to Save More Money

Jul 09, 2023Hello Stoic Investors,

Today I want to show you a simple strategy that will allow you to keep more of your salary.

You read my previous article, right?

In case you didn’t, let me share one piece of wisdom.

Every road to financial freedom starts with a good budget.

You need to be the master of your money. Not the other way around.

These New Year resolutions clearly state there is a problem in this area.

Think about it.

How many of your friends have no control over their money? Credit card debt, cars they can’t

afford, expensive dining every week etc.

If you spend every penny you make, you’ll never retire.

But then again, you still want to live your life to the fullest right?

So how do you find a good balance between spending and saving?

Set boundaries.

If you have children they probably know where your boundaries are.

So why not set them to your money as well.

But please, don’t complicate it. Even though some budgeting coaches like to present it as rocket science, it

doesn’t have to be that way.

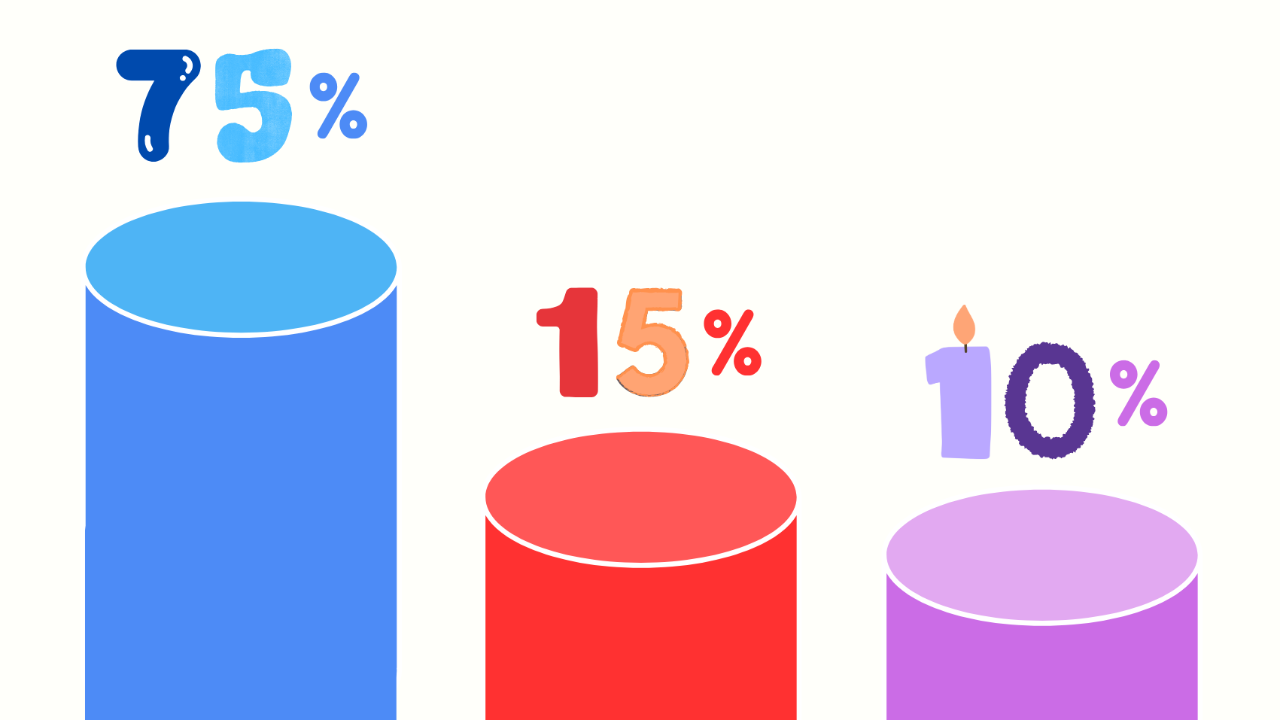

Just put 20% of your salary in a separate account and don’t touch it - or maybe even invest it ;)

That leaves you with 80%. In order to live life to the fullest, you definitely want to keep your expenses low.

Why? Because then, you have more for fun activities!

Since you read this far, here is a gift for you.

30 unique tricks to save like a pro

- Use a water filter: Instead of buying bottled water, invest in a water filter for your home. This will save you money over time and reduce plastic waste.

- Practice the 30-day rule: Before making a non-essential purchase, wait for 30 days.

- Take advantage of free online resources: Utilize free online resources such as e-books, podcasts, educational courses, and tutorials. There are numerous platforms available that offer valuable information and entertainment at no cost.

- Use cashback apps: Install apps that offer cashback on purchases and redeem the rewards.

- Buy in bulk: Purchase non-perishable items or everyday essentials in bulk to save money in the long run.

- Cook at home: Prepare meals at home instead of eating out to save on dining expenses.

- Shop with a grocery list: Plan your meals in advance and stick to a shopping list to avoid impulse purchases.

- Use loyalty programs: Join loyalty programs at your favorite stores to receive discounts and exclusive offers.

- Cancel unused subscriptions: Review your subscriptions and cancel the ones you no longer need or use.

- Negotiate bills: Contact service providers to negotiate lower rates for cable, internet, or insurance.

- DIY projects: Learn to do simple repairs and maintenance tasks yourself instead of hiring professionals.

- Use public transportation or carpool: Save money on fuel and parking by using public transport or sharing rides.

- Cut down on energy usage: Turn off lights, unplug electronics, and use energy-efficient appliances to reduce utility bills.

- Shop at thrift stores: Find great deals on clothing, furniture, and household items at thrift stores.

- Comparison shop: Before making a purchase, compare prices online or in different stores to get the best deal.

- Sell unused items: Declutter your space and sell items you no longer need to make extra cash.

- Embrace DIY gifts: Make personalized gifts for birthdays and holidays instead of buying expensive ones.

- Borrow instead of buying: Borrow books, movies, or tools from libraries or friends instead of purchasing them.

- Utilize free entertainment: Explore free activities such as hiking, picnics, or visiting local museums or parks.

- Quit bad habits: Cut down on smoking, excessive drinking, or other costly habits to save money and improve health.

- Use a programmable thermostat: Set your thermostat to automatically adjust temperatures when you're not at home to save on heating and cooling costs.

- DIY cleaning products: Make your own cleaning supplies using inexpensive ingredients like vinegar, baking soda, and lemon.

- Cancel gym memberships: Consider exercising outdoors or using free workout videos instead of paying for a gym membership you rarely use.

- Repair instead of replacing: Fix broken items instead of immediately replacing them.

- Utilize discount codes and coupons: Before making online purchases, search for discount codes and coupons that can help you save money.

- Plan outings strategically: Look for discounted movie tickets, restaurant deals, or happy hours to enjoy entertainment at a lower cost.

- Unsubscribe from marketing emails: Avoid temptation by unsubscribing from promotional emails that may tempt you to spend unnecessarily.

- Host potluck gatherings: Instead of going out to eat with friends, host potluck dinners where everyone contributes a dish.

- Use free budgeting apps: Explore free budgeting apps that help you track your expenses and find areas to save.

- Buy generic or store brands: Opt for generic or store brands instead of name brands. Often, the quality is comparable, but the price is significantly lower, allowing you to save money on groceries and household items.

Here is a challenge for you:

Pick one of these and implement it right away.

A penny saved is a penny earned.

So, note down these points and start saving today:

1. Every road to financial freedom starts with a good budget

2. If you spend every penny you make, you’ll never retire.

3. $10 saved and invested every month can grow into +$50,000 in 40 years.