What you need to know Before You Invest

A simple guide for beginners written by Vittorio, Money Coach and Stoic Money Founder

Get your copy today for free

✅ Prepare yourself financially

✅Learn how to create a realistic plan for managing your money

✅Explore ways to structure a long term approach that fits your goals

I want to receive the Guide for free!Level up your skills before you invest!

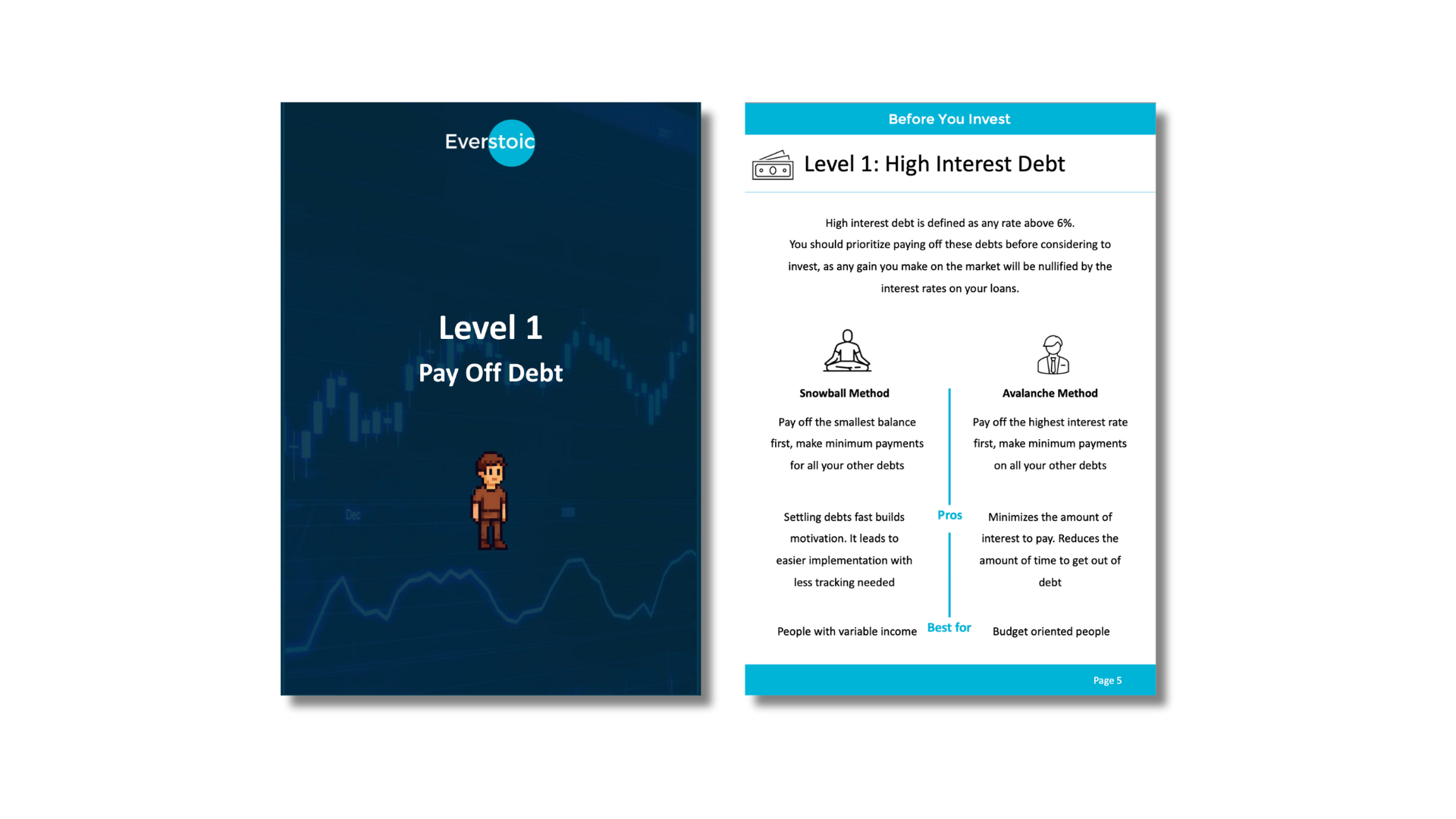

Level 1

Pay off Debt

-

Learn why paying off debts above 6% is often recommended before investing

-

Discover the Snowball and Avalanche methods and pick the one that suits your income

-

Free up cash to start exploring investing in a way that works for your situation

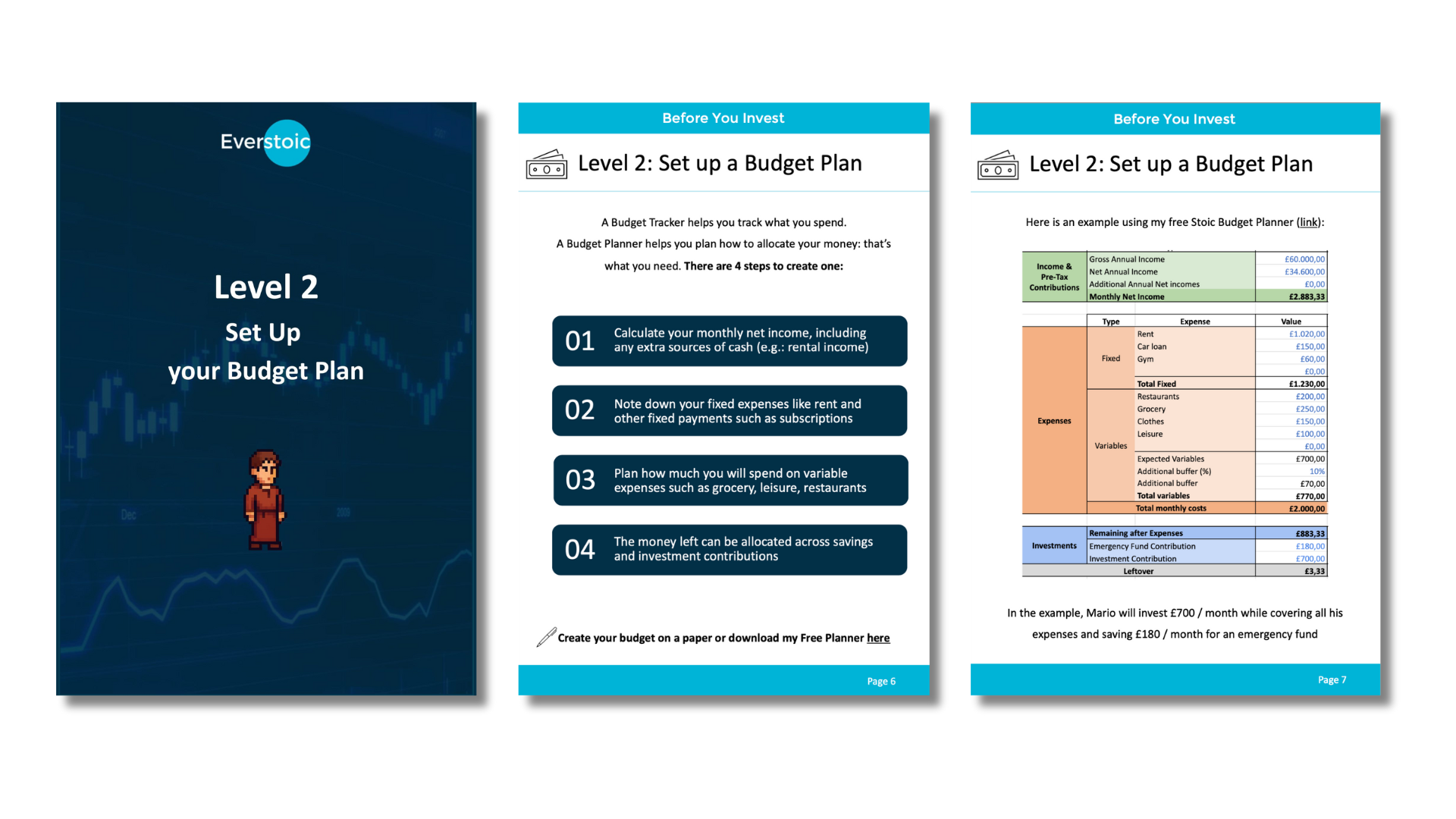

Level 2

Set up your Budget Plan

-

Follow the 4-step method to calculate income, expenses, and savings goals

-

Decide how much to allocate to essentials, lifestyle, and your approach to investing

-

Use my free Budget Planner to automate and simplify your money management

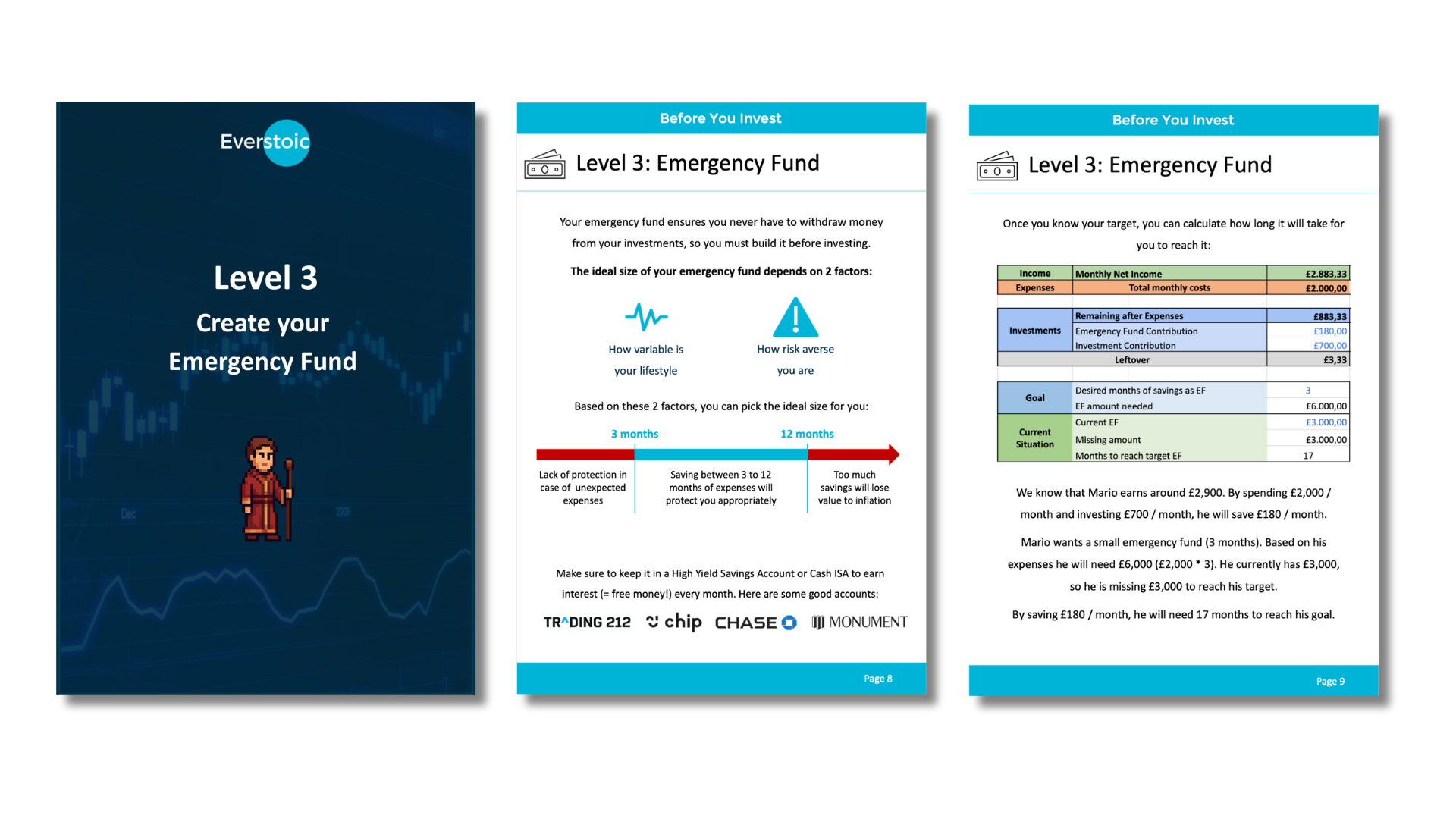

Level 3

Create your Emergency Fund

-

Understand how your lifestyle and risk tolerance can help you decide an appropriate fund size

-

Learn the 3–12 guidelines rule to protect your money from unexpected expenses

-

Store it in a High-Yield Savings Account or Cash ISA to potentially earn monthly interest

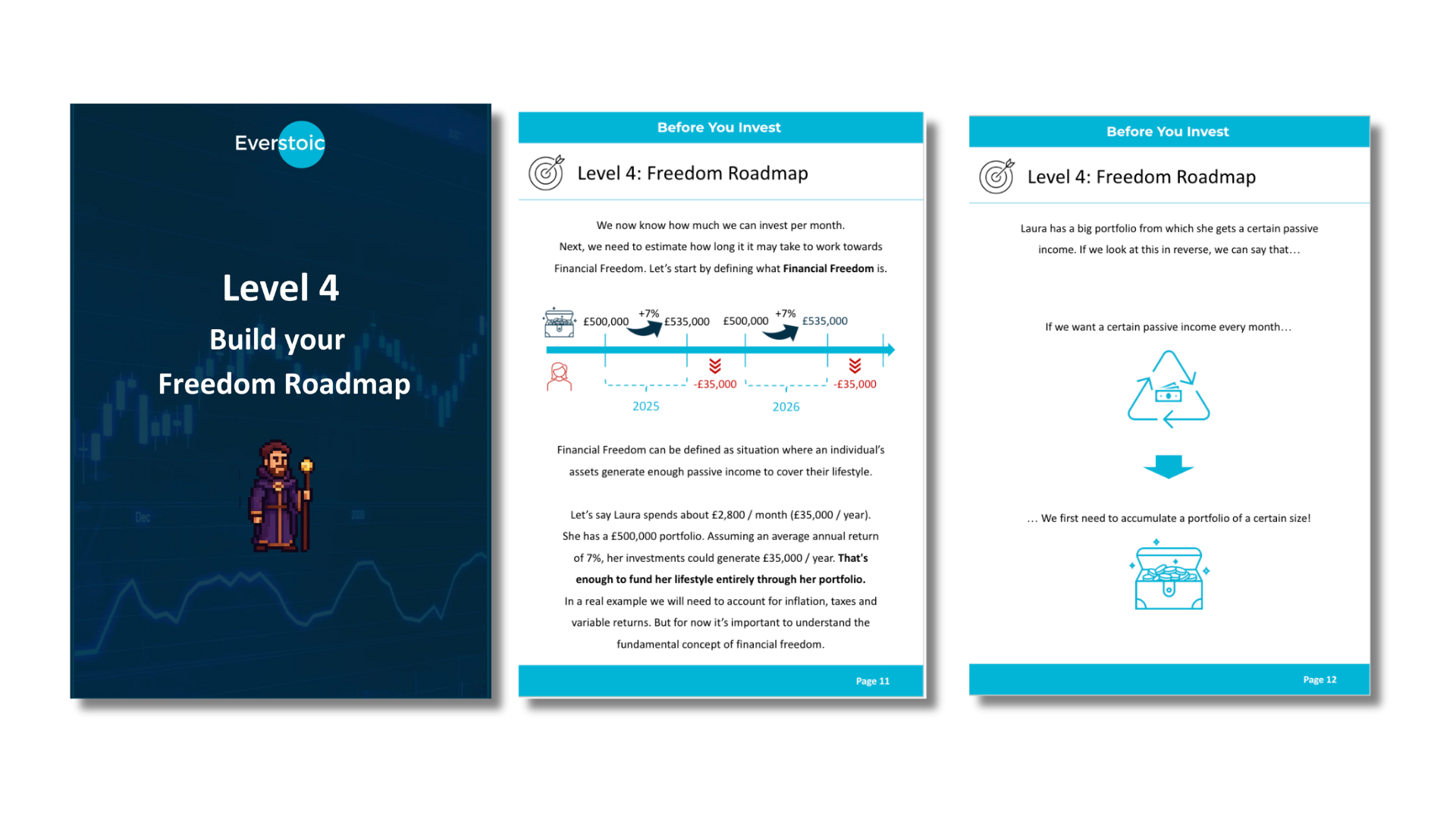

Level 4

Build your Freedom Roadmap

-

Explore what Financial Freedom could mean for you in numbers, not theory

-

Learn how to estimate how long it might take to work toward making work optional

-

See examples of how returns and withdrawals could contribute to generating passive income

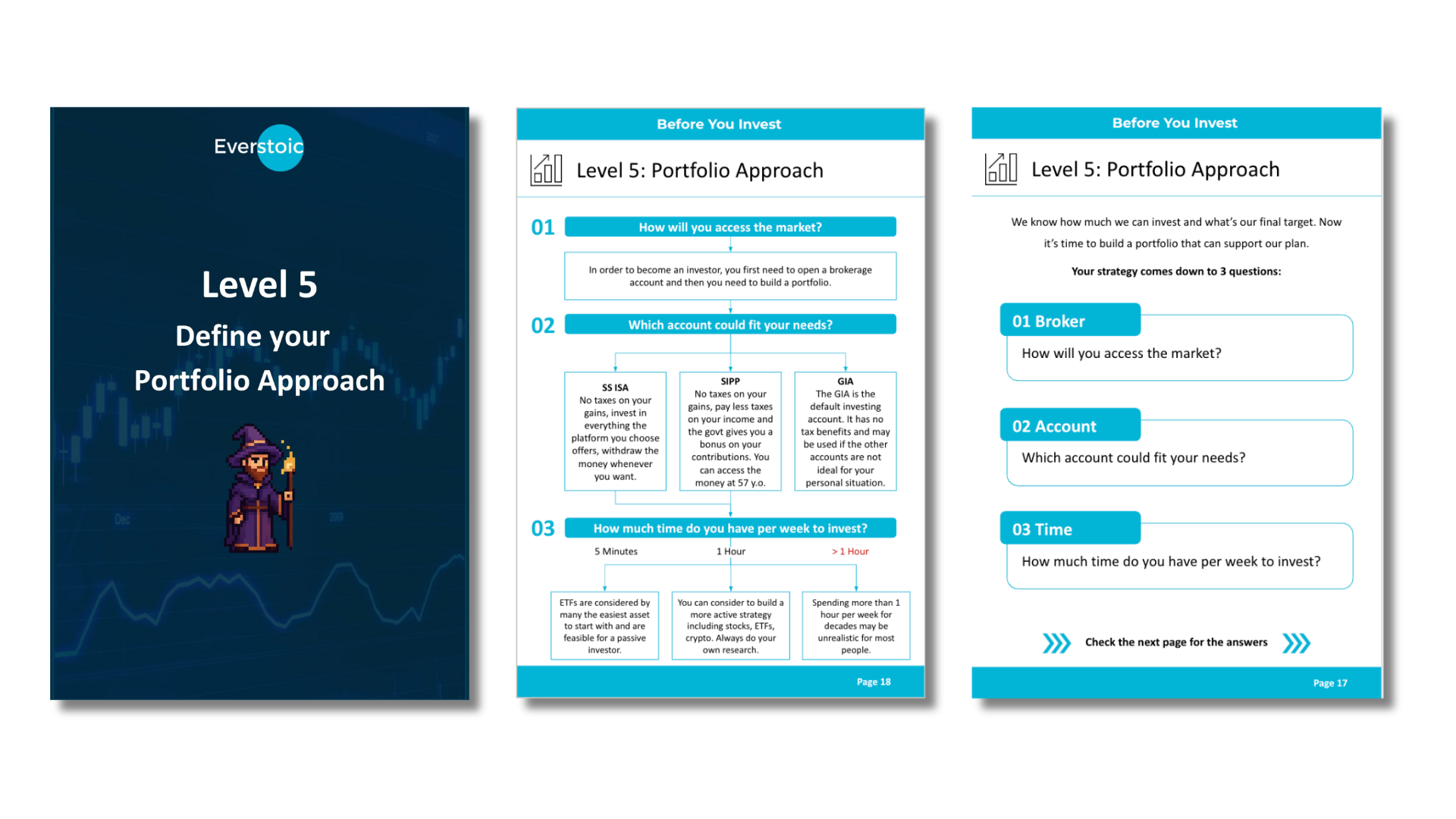

Level 5

Define your Portfolio Approach

-

Explore how to access the market with a suitable broker and account type (ISA, SIPP, GIA)

-

Match your investing style with the time you can realistically dedicate each week

-

Build a portfolio approach that aligns with your goals, effort level, and potential tax advantages